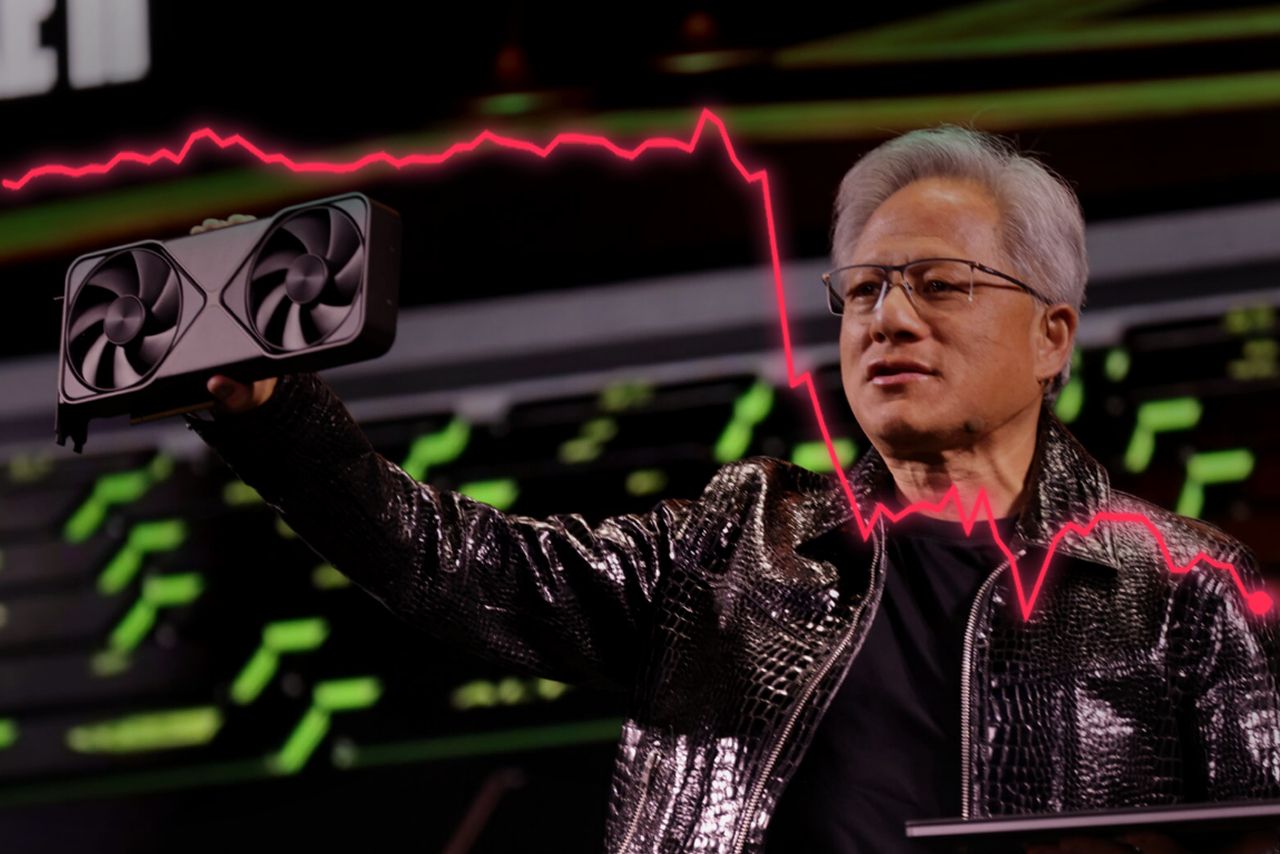

Nvidia Stock Plummets as New DeepSeek AI Model Disrupts Market

|

|

Key points

- Nvidia stock dropped 17% in a single day.

- Sell-off was set off by increased Chinese competition from DeepSeek AI.

- The investor panic wiped nearly $600 billion off Nvidia’s market value.

Nvidia, a leading chip manufacturer, experienced a significant stock decline on January 27, 2025, with shares dropping nearly 17% to close at $118.42. This decline erased approximately $593 billion in market value, marking the largest single-day loss for any public company in U.S. history.

The sell-off was triggered by the emergence of DeepSeek AI, a Chinese startup that unveiled an advanced artificial intelligence model, R1, capable of competing with existing U.S. technologies at a lower cost. DeepSeek’s AI assistant became the No. 1 downloaded free app on Apple’s iPhone store on the same day as Nvidia’s stock plummeted.

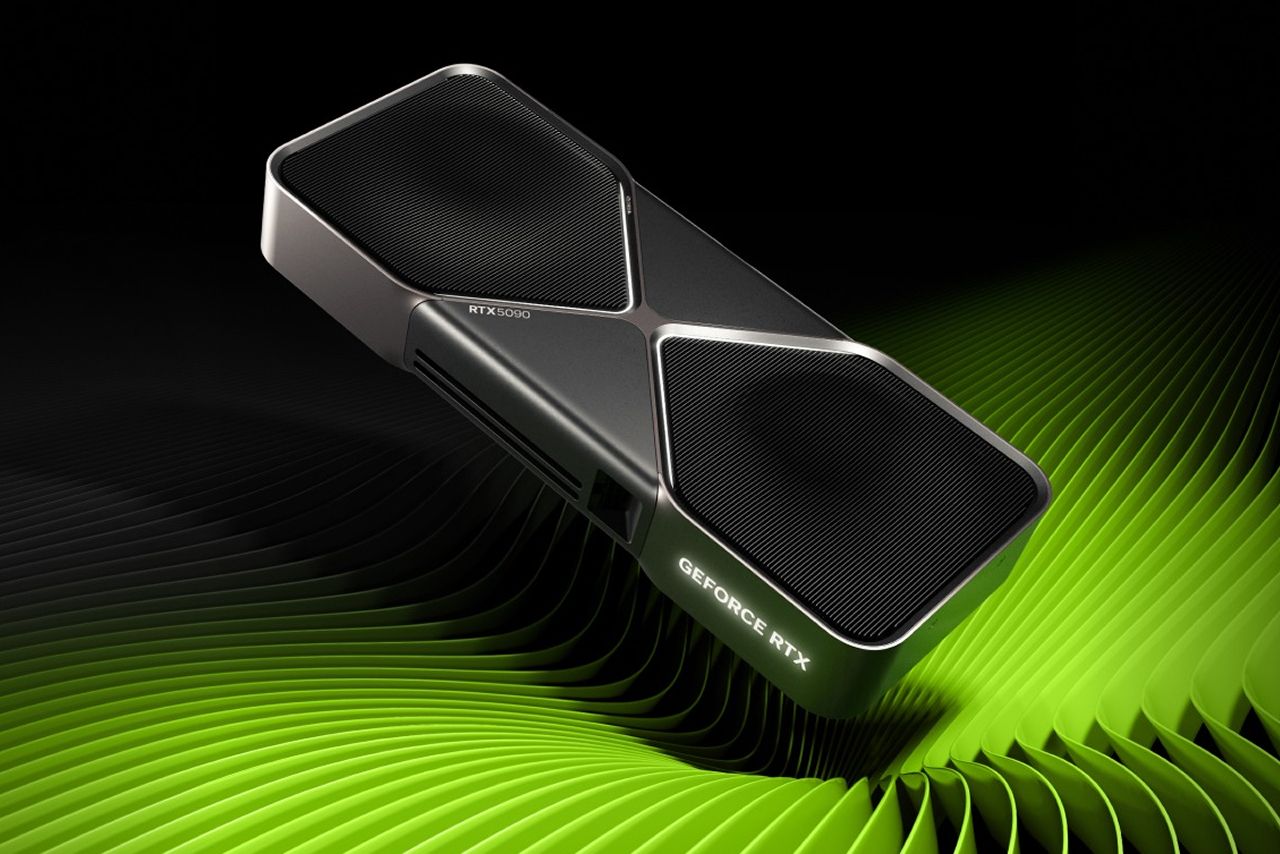

The emergence of DeepSeek AI’s R1 model has significantly challenged Nvidia’s dominance in AI hardware. R1’s developers claim the model achieves comparable results to state-of-the-art AI systems while requiring far fewer GPUs to operate. This innovation undermines Nvidia’s role as the primary hardware provider for AI workloads, as businesses may now view DeepSeek’s approach as a more cost-effective alternative to Nvidia’s high-end, expensive GPUs.

Investors previously inflated Nvidia’s stock price due to its perceived indispensability in AI. The R1 model’s success highlighted that Nvidia’s dominance in the AI space was no longer guaranteed, triggering panic-selling that compounded the stock’s dramatic drop. This development also raised broader questions about the future trajectory of AI hardware, as the industry may shift toward more streamlined, cost-effective solutions that reduce reliance on Nvidia’s GPUs.

This development led to a broader tech stock decline, with the Nasdaq 100 falling about 3% and the S&P 500 down nearly 2%. Shares of other tech giants, including Microsoft, Alphabet, and Palantir, also experienced declines.

Prior to this downturn, Nvidia had surpassed Apple as the most valuable publicly traded company. Following the stock drop, Nvidia fell to third place, behind Apple and Microsoft. This event marks Nvidia’s most significant decline since March 2020.