AMD reportedly plans 10% GPU price hike amid memory crisis

|

|

Key points

- Industry reports say AMD has notified board partners of a second planned GPU price increase.

- The price hike is expected to be at least 10% and tied to higher GDDR6 costs and broader DRAM pricing pressure.

- The hike may not hit retail all at once because GPUs move through multiple channels, but future shipments will land at a higher cost.

AMD has notified its partners of a second planned price hike for its GPUs (including Radeon lineup) in a short period, due to a memory shortage and pricing pressures. According to industry sources, the upcoming price increase will be at least 10% and will affect the entire product line.

Per UDN report, AMD is raising GPU prices for its board partners by 10% due to a sharp rise in GDDR6 memory costs and a DRAM market driven by AI and data center demand. In practice, this means that future GPU shipments from AMD will have to be shipped from the factory at a higher price, opening the door to a price increase as existing stocks are depleted.

A graphics card typically passes through several companies before it reaches retail, so any cost increase does not show up immediately, especially if AMD keeps the official MSRP unchanged. Our article explains the pricing chain using Nvidia gaming GPUs as an example, but AMD follows a similar partner and distribution process.

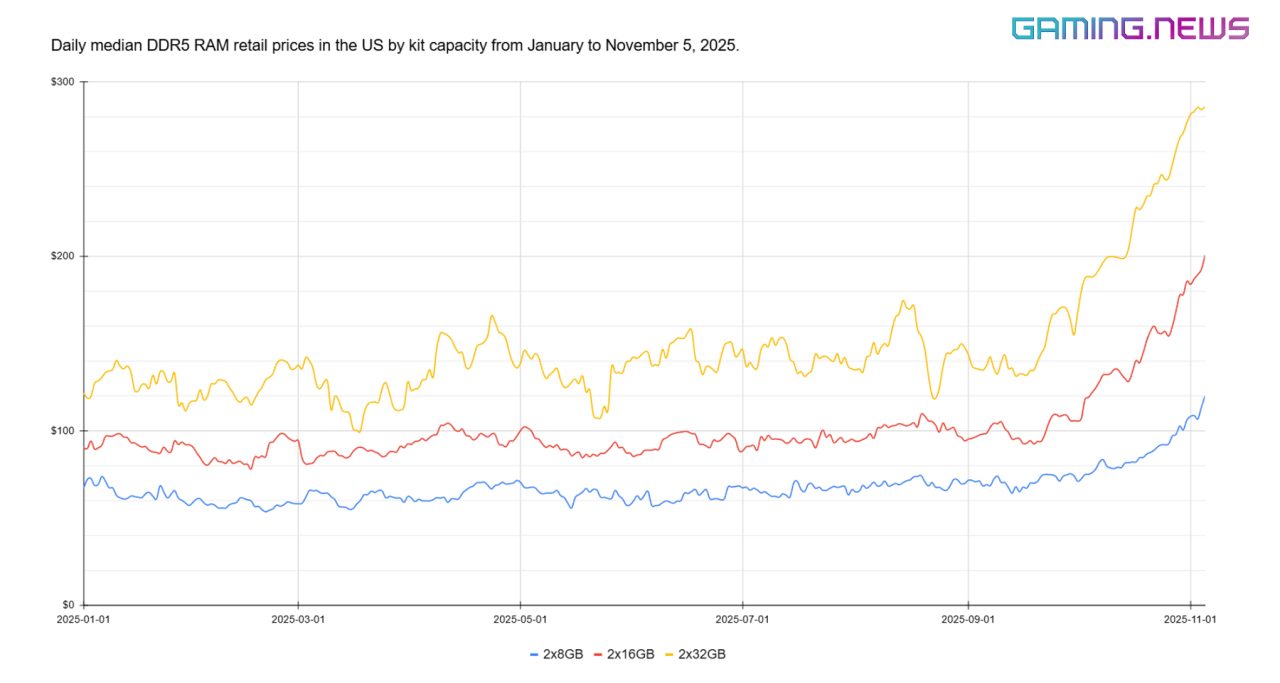

The main reason for the decision is the ongoing global memory crisis called DRAM supercycle. This upcycle has already driven a sharp increase in retail RAM prices and is now starting to affect other hardware. The cost of base DRAM modules on the market has almost tripled this year.

Since AMD supplies partners with complete kits (GPU and memory), the price increase of the latter component directly affects the final cost of their graphics card.

Retail GPU prices are still mostly above MSRP

This situation poses additional challenges for AMD. For almost the entire market cycle, Radeon RX 9070 XT retail prices didn’t match AMD’s MSRP. GPUs only recently began appearing at the stated price in the lead-up to Black Friday, and now a new wave of price increases could further push products away from their target price points.

Against this backdrop, a representative of one of the AIB partners, PowerColor, initially recommended that customers purchase graphics cards asap while sales are in effect and before the new prices take effect next year, but later stated that his remarks had been misinterpreted.

Industry observers are hopeful that AMD has long-term contracts for GDDR6 memory, which could delay the immediate implementation of the new prices. Otherwise, the market could see additional price hikes for Radeon GPUs at the beginning of next year—a further blow for consumers amid a lack of news about the GeForce RTX 50 SUPER graphics cards, whose launch was also rumored to have been delayed due to rising memory prices.

Price hike for the base GPU component

Prices for GDDR6/7, the memory used in many modern GPUs, have already increased by approximately 30% on the spot market through 2025. This may seem trivial at first glance, but the impact is quickly felt when dealing with 8-16 gigabytes per GPU and millions of units produced.

Independent estimates indicate that this roughly 30% increase in GDDR6 costs adds $10 to $15 to the price of a 16GB GPU. Factoring in manufacturer margins, graphics card partners’ margins, and retailer margins, this isolated increase could lead to a $25 to $40 increase in the final consumer price.

Memory crisis to hit a wide range of gaming hardware

In November 2025, reports based on hardware insider claims suggested Nvidia‘s unannounced GeForce RTX 50 Super refresh could be delayed or even canceled due to a shortage of higher-density 3 GB GDDR7 memory modules, which the rumored 18 GB and 24 GB Super configurations would rely on. The same supply pressure was also framed as a risk for higher prices or limited availability across the existing RTX 50 lineup if GDDR7 costs stay elevated.

Another report we covered said that both AMD and Nvidia are weighing cutting some entry-level and mid-range gaming GPUs if GDDR VRAM becomes too large a share of the bill of materials, with budget cards like the Radeon RX 9060 XT and GeForce RTX 5060 class models seen as most vulnerable to margin pressure.

Board partners are considering lower VRAM configurations to keep costs down, but neither company has officially confirmed MSRP changes or cancellations.

Next, hardware insider Moore’s Law Is Dead claimed Microsoft has warned partners about a looming RAM shortage that could push Xbox Series X|S prices higher again in the near term, with potential short supply also affecting availability. Xbox Series X|S has already seen two price increases in 2025, in May and September, likely tied to US tariffs rather than memory costs.

Why is PC hardware getting more expensive?

Some of the specifics come from hardware insiders’ reporting, but the overall direction matches what the memory market has looked like in 2025. In the second half of 2025, DRAM prices rose rapidly, and consumer DDR5 pricing followed, with retailers raising everyday prices as new stock arrived at higher costs and shortages spread across the channel.

According to our research, DDR5 RAM kits almost doubled in price for consumers in 2 months.

The main driver is AI demand, which is pulling memory supply toward higher-margin server DRAM and HBM, leaving less capacity for consumer parts like DDR5 kits and GDDR VRAM. Major suppliers have pushed contract pricing higher during 2025, and recent reporting describes large jumps in server memory contract prices over short periods.

This dynamic is often described as a DRAM supercycle, meaning demand stays above supply for an extended stretch and pricing remains under upward pressure. Analysts expect the current upcycle to peak around 2027.

One factor behind the demand shock is OpenAI’s Stargate sourcing push with Samsung Electronics and SK hynix. OpenAI says the partnerships target 900,000 DRAM wafer starts per month, and industry coverage has framed that scale as potentially approaching 40% of global DRAM output if fully ramped.

Smartphones have also been affected by the same memory cost pressure, with some new Xiaomi models launching at higher prices. After public backlash, specific models were temporarily discounted.