Xiaomi warns phone prices will rise as memory costs keep surging

|

|

Key points

- Xiaomi’s head, Lu Weibing, says rising memory costs have reached retail.

- After pushback, the 12/512 GB Redmi K90 will be temporarily discounted.

- As AI increasingly consumes memory supply, retail DDR5 RAM prices continue to rise, and other consumer and gaming devices may follow.

Xiaomi warns that memory inflation is far beyond expectations and could intensify as AI demand tightens hardware component supply. The DRAM supercycle is already lifting PC DDR5 RAM retail prices and is likely to spill over into consumer and gaming devices soon.

In a Weibo post, Xiaomi President Lu Weibing said rising memory costs have reached retail pricing. After consumer pushback, Xiaomi will temporarily reduce the price of the 12/512 GB K90.

The company links the pressure to global AI demand, which has diverted supply and driven up the prices of DRAM and NAND, used in all types of memory and storage, respectively.

Rising prices of gaming and PC hardware

Xiaomi’s warning about phones is an early signal of broader pricing changes that have trickled down from base components to end products.

For gamers, the AI-driven memory squeeze won’t stop at PCs: higher DRAM and NAND costs are likely to push up prices (or trim base configs) on smartphones and handheld gaming PCs next, since these devices rely on the same component supply that’s being tightened by AI build-outs.

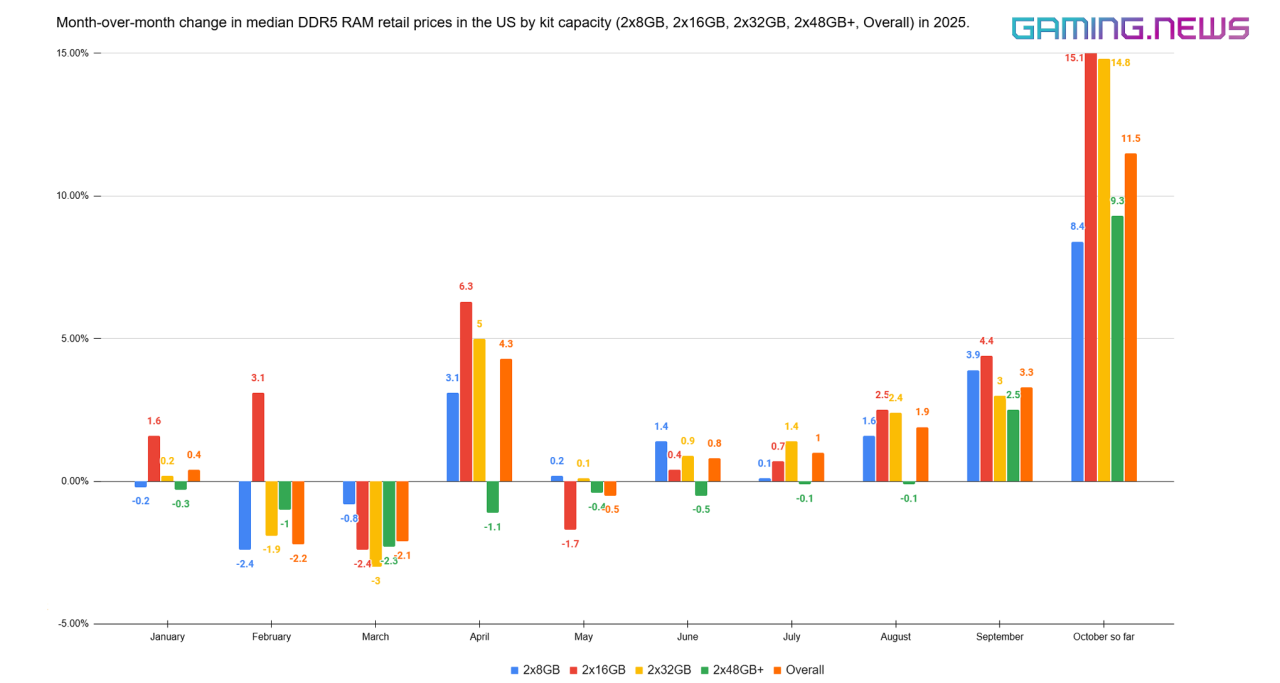

On PC RAM specifically, our analysis shows retail DDR5 median prices surged about 15% on October 10 and 30% on October 20 for 2×16 GB and 2×32 GB kits, compared to September. Starting September 22, every week has shown a median increase of 4-6% (and now even more), evidence that upstream DRAM hikes are already reaching consumers.

It is also logical to assume that the rise in DRAM prices will eventually affect GPUs. Graphics cards use GDDR6, GDDR6X, and GDDR7, which share the same supply and manufacturing capacity. The impact usually arrives with a lag, first as higher AIB list prices on mid-range models, then as adjusted MSRPs for new GPUs as OEM contracts expire.

Why RAM is getting more expensive

AI projects are absorbing DRAM budgets and HBM capacity, so suppliers are redirecting wafers, packaging, and logistics toward servers. That tightens supply for conventional DRAM and NAND, lifts contract quotes first, and retail prices follow later.

According to recent reports, major memory manufacturers increased DRAM prices by up to 30% in Q4 2025.

Recent examples of capital and supply commitments that drain memory capacity:

- Nvidia invests $2 billion in xAI, tied to an estimated $20 billion GPU supply arrangement.

- Nvidia commits about $5 billion to Intel CPUs.

- Nvidia may invest up to $100 billion in OpenAI and bring 10 GW of AI GPUs.

- OpenAI signs a new GPU supply deal with AMD.

- Broadcom and OpenAI for 10 GW of custom AI accelerators.

Several analysts now frame this as a DRAM supercycle through 2027: a multi-year period in which demand outpaces supply, driving repeated price hikes. It is not a single hike before the seasonal discounts.

Micron warns there will be no relief in 2026 as supply continues to trail demand across the memory market, implying further RAM price increases.

Adata chairman Simon Chen says AI data centers are outbidding the PC market, cutting upstream DRAM/NAND inventories to roughly 2–3 weeks and raising the risk of RAM and SSD shortages.

DRAM supercycle

In 2017-2019, the DRAM market ran through a similar supercycle: smartphones added more memory per device while cloud providers built out data centers, suppliers kept capex tight, and prices climbed quarter after quarter. Retail DDR4 RAM kits doubled prices in a year. OEMs trimmed RAM in mid-range laptops to hold bills of materials, and consumers either paid more for the same capacity or accepted smaller configs.

By late 2018, the cycle turned: channel inventories built, contract talks slowed, and retail began to ease, with a broader price correction through 2019.

We are seeing the same pattern as 2017-2019: lean inventories and capacity being steered to higher-margin lines (now HBM for AI) leave other memory types exposed to sustained price pressure.

Retail DDR5 RAM prices are already rising, and now OEMs are being hit with hikes too to keep bills of materials in check. Then the market shifted from DDR3 to DDR4; now it is moving from DDR4 to DDR5. Result—fewer discounts and a steady rise in retail prices for mainstream RAM kits.