Micron says no relief for memory in 2026; PC RAM prices to rise

|

|

Key points

- Micron warns there will be no relief for the memory market in 2026, and an industry-wide imbalance will persist as supply trails demand.

- Adata has already issued a similar warning because AI is rapidly absorbing DRAM inventories.

- For consumers, that means DDR5 RAM prices will keep rising throughout the following year as well.

Micron warns the DRAM market will remain extremely tight with the supply-demand imbalance only worsening through 2026. For consumers, this will result in multiple surges in PC RAM prices and possibly worsen overall memory availability; the first hikes have already reached retail.

According to a DigiTimes report, Micron, one of the largest memory manufacturers, signals that 2026 will not bring any relief for the ongoing memory crisis.

DRAM supercycle will continue, supply will stay tight, the whole memory market situation will become worse, and the supply-demand balance will not reset on its own. This is a memory industry outlook, not a Micron-specific issue.

Emerging memory crisis

A few days earlier, Adata chairman Simon Chen warned that AI data centers are outbidding the PC market and draining DRAM and NAND, leaving only 2-3 weeks of supply and raising the risk of consumer RAM and SSD shortages into 2026.

AI buildouts consume large amounts of memory: GPUs/AI accelerators ship with HBM (stacked DRAM), while the surrounding servers still need substantial quantities of conventional memory.

With thin inventories and demand outpacing capacity, suppliers ration output, raise contract prices, and prioritize higher-margin parts/deals. Because of this, analysts are already predicting a DRAM supercycle through 2027.

DDR5 RAM prices are surging

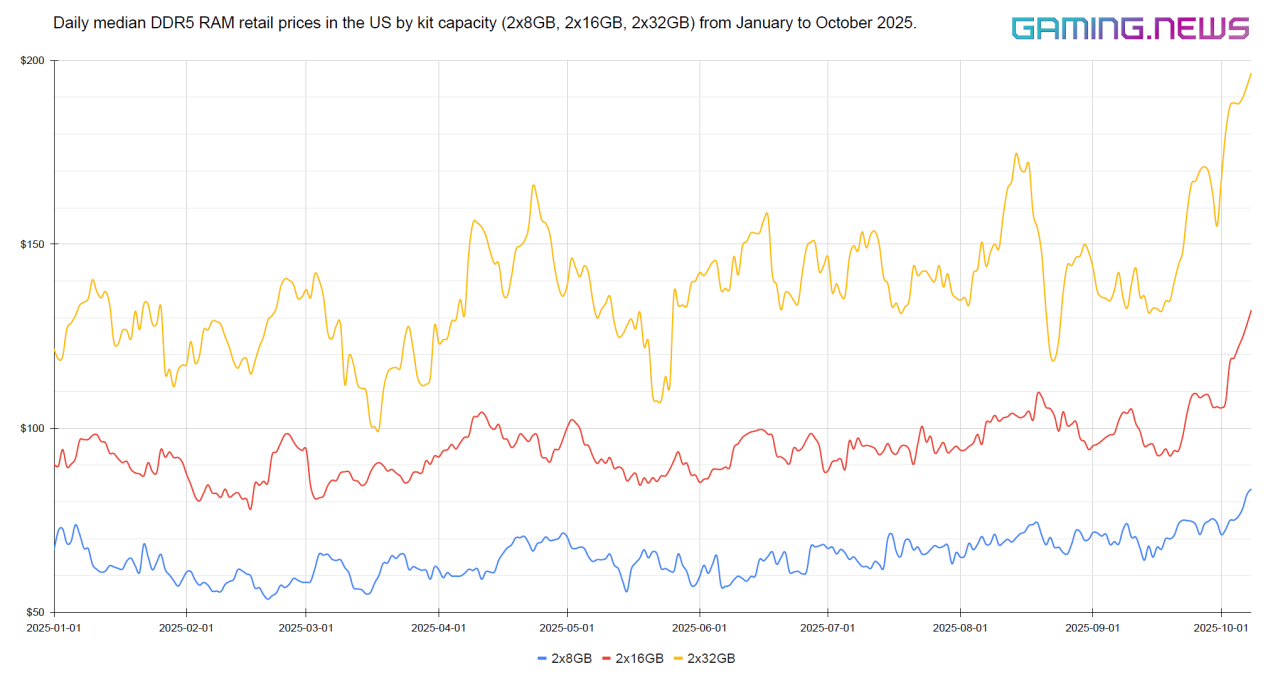

Retail DDR5 RAM prices have already moved due to hikes from major memory manufacturers.

According to our research, US medians for 2×16 GB and 2×32 GB kits rose roughly 15% by Oct. 10 and around 20-30% by Oct. 20 (compared to September 2025). Weekly prices for those capacities are climbing ~5% for four straight weeks.

AI hardware boom

All this aligns with the extreme pace of AI infrastructure expansion:

- Nvidia to invest up to $100 billion into OpenAI and deploy 10 GW of AI accelerators.

- Nvidia invested $5 billion in Intel, marketed as a buy-in collaboration to develop custom AI chips.

- Nvidia to invest $2 billion in xAI to lock a deal for its own AI GPUs worth $20 billion.

- OpenAI signed a GPU deal with AMD.

- OpenAI lines up a deal to get up to 10 GW chips from Broadcom.

Previous DRAM supercycle

This is not the first time the DRAM market looked like this. In 2017, demand for smartphone and server memory ran ahead of supply for multiple quarters.

Both DRAM spot and RAM retail prices climbed for 1.5 years until inventories were rebuilt. The previous DRAM supercycle sets the pattern for today’s market dynamics.