OpenAI lines up 10GW Broadcom chip deal to ease Nvidia reliance

|

|

Key points

- Multi-year OpenAI-Broadcom deal will design and deploy in-house AI chips, targeting 10GW from H2 2026 through 2029.

- OpenAI still relies on Nvidia in the near term, a separate partnership plans at least 10GW of systems and up to $100B invested.

- As for regular users, AI demand increases the cost and availability of base components, making PC and gaming hardware pricier.

OpenAI and Broadcom will co-develop custom AI accelerators, with plans for approximately 10 gigawatts of deployments, which will start in the H2 2026. Sam Altman’s company also has a 10GW Nvidia partnership; the new deal is meant to lower its reliance on Nvidia’s GPUs over time.

OpenAI signed a multi-year deal with Broadcom to co-develop and deploy roughly 10 gigawatts of in-house AI accelerators and rack systems. OpenAI will design the chips and other systems, while Broadcom will handle development and rollout, with first deployments planned for the second half of 2026 and full buildout by 2029.

This is a long-term capacity plan meant to give OpenAI more control over cost and supply. Separately, the company already has a partnership with Nvidia for the deployment of at least 10 gigawatts of systems, plus $100 billion investment.

The Broadcom deal doesn’t change the near-term picture: OpenAI still relies on Nvidia to run and scale its business through 2026. OpenAI would remain dependent on Nvidia even as its own chip effort progresses, and recent reports suggest OpenAI may lease Nvidia GPUs to reach its 10GW target.

Recent major AI hardware deals

- Nvidia is set to invest $2 billion in xAI, which may then acquire $20 billion worth of Nvidia’s chips.

- Nvidia invests $5 billion in Intel to co-develop SKUs.

- OpenAI signed a deal with AMD for additional GPU supply.

- Nvidia intends to invest up to $100 billion in OpenAI and deploy up to 10 gigawatts of AI accelerators.

These announcements are about AI infrastructure, not consumer graphics. We cover them because they put pressure on base hardware components (DRAM and NAND) and the priorities of memory makers. Leading manufacturers are already hiking prices, driven by demand and potential shortages.

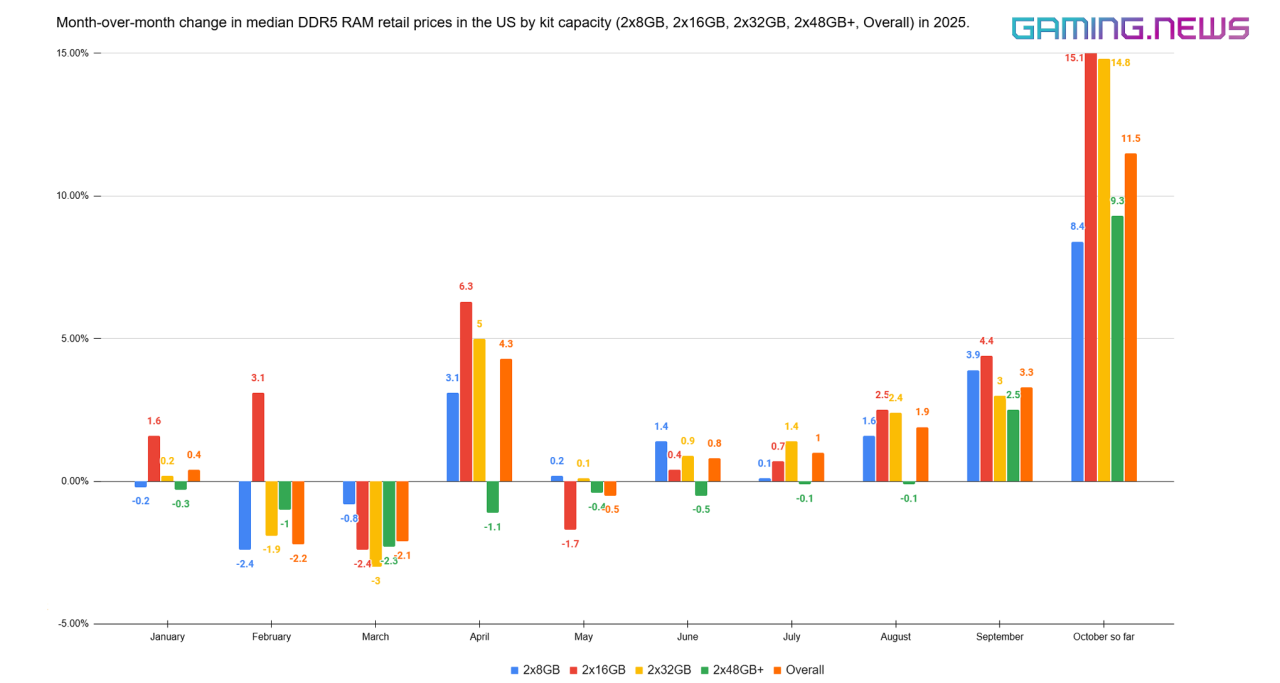

Analysts predicted a DRAM supercycle at least until 2027, with inventories near 2018 lows and vendors steering output toward AI parts. Contract prices are increasing quarter over quarter, and this shift is now impacting retail. Retail RAM and high-capacity SSDs will be repriced first. Other PC parts, consoles, laptops, and handhelds will follow as OEM contracts renew.

DDR5 RAM kit prices have risen about 15% this month, following three consecutive weeks of roughly 5% gains, with the latest week showing even bigger increase. Because gaming GPUs run on DRAM-based GDDR, they’re likely to reprice soon when OEM contracts expire. We’ve completed our consumer RAM price analysis; next, we’re tracking SSDs and GPUs with weekly updates and news posts.

OpenAI is the company behind ChatGPT and the GPT family of models. It trains large AI systems and serves them to consumers and developers, which makes compute supply and cost a core part of its business.

Broadcom is a global semiconductor and infrastructure company: it builds networking chips, storage controllers, and does custom chip manufacturing.