Exclusive: DDR5 RAM kit prices surge 15% this month as DRAM hikes reach consumers

|

|

Key points

- Median US DDR5 RAM prices are up 15% month to date (through October 10) for 2×16GB and 2×32GB kits.

- Weekly medians for 2×16GB and 2×32GB rose 4% to 5.5% for three straight weeks; other capacities are up more slowly.

- AI hardware demand and the projected DRAM supercycle offer consumers little respite.

Median DDR5 RAM retail prices have spiked 15% month to date for 2x16GB and 2x32GB kits, and the trend is still upward. For a 2×16GB DDR5 kit, the median price was $95.20 on September 1, $105.60 on October 1, and $132.10 on October 8.

Memory price hikes tied to AI demand have reached consumers, with broad pass-through across all capacities and clock speeds, as the new DRAM supercycle gains momentum.

Disclaimer: methodology is detailed a bit more at the bottom. In short, we analyzed almost a year of daily raw price records for 250+ distinct PC DDR5 kits from Amazon and other major US retailers.

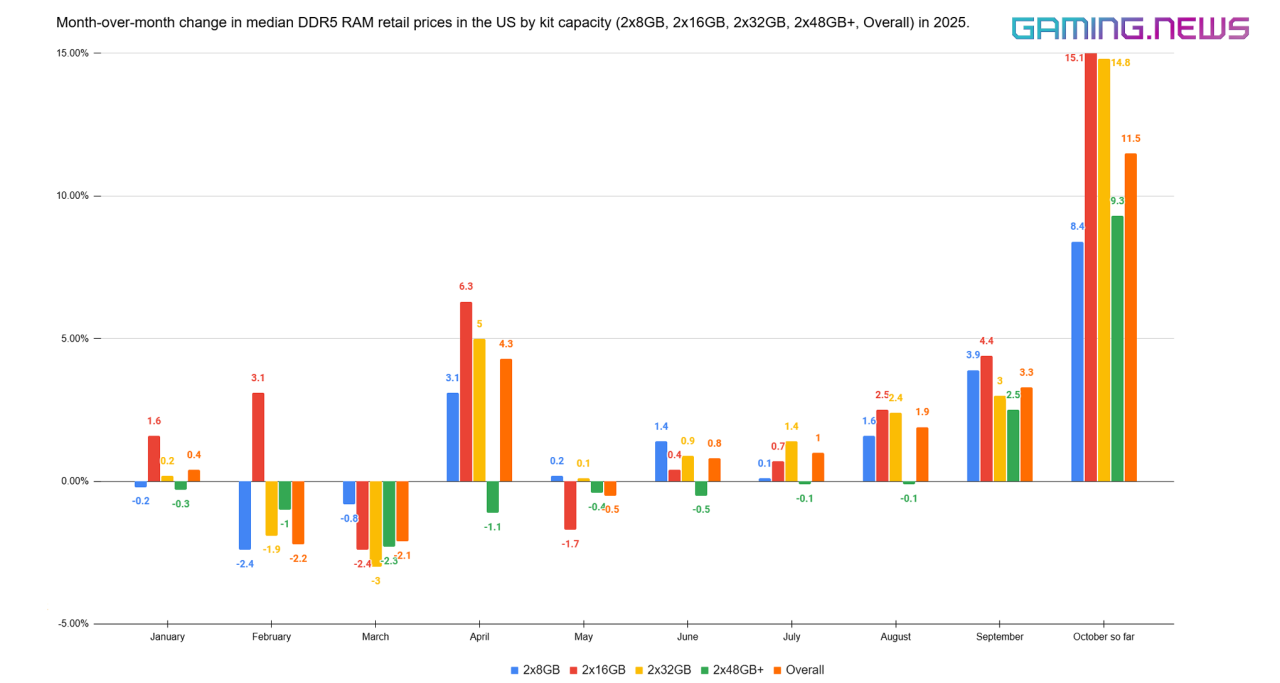

MoM change in DDR5 RAM retail median prices in the US, 2025

October is only 10 days in, but the direction is clear: retail DDR5 prices are rising across all capacities. Weekly data confirm the trend, with DDR5 retail prices of 2x16GB and 2x32GB kits increasing by 4% to 5.5% each week over the past three weeks (see the table below); these 2 groups are the most relevant for gamers, in my opinion.

Week-over-week cut

Week

2x16GB

2x32GB

September 1-7

0.7%

0.1%

September 8-14

0.7%

0.1%

September 15-21

1%

0.9%

September 22-28

4.9%

5.4%

September 29-October 5

4.1%

4.9%

October 6-10

4.7%

5.1%

DDR5 kits are grouped by capacity only. A detailed pass over the data showed that within a single capacity, different clock speeds change the medians only marginally, so to avoid multiplying categories and to keep the charts readable, we present the split by capacity and omit a separate clock breakdown.

2x48GB and 2×64GB kits target beyond the usual consumer/gaming use case; their retail medians track closely, and sample sizes are limited compared to lower capacity RAM, so we put them together as “2×48GB+” for better readability.

Key points:

- Consumer DDR5 prices have risen across all models, with the largest monthly step of about 15% on 2x16GB and 2×32GB RAM kits.

- On slower prices for 2×8GB kits, it’s likely that older inventory is still being cleared, so new pricing filters through gradually.

- The first apparent price move began in late September.

- It appears that October Prime Day and other promotions did not significantly slow price hikes.

- The April anomaly most likely reflects US tariff news.

- October values are month-to-date and will be updated afterward.

- For clarity, the full table is listed below.

US PC DDR5 RAM MoM median price change by capacity (2025)

Month

2x8GB

2x16GB

2x32GB

2x48GB+

Overall

January

-0.2%

1.6%

0.2%

-0.3%

0.4%

February

-2.4%

3.1%

-1.9%

-1%

-2.2%

March

-0.8%

-2.4%

-3%

-2.3%

-2.1%

April

3.1%

6.3%

5%

-1.1%

4.3%

May

0.2%

-1.7%

0.1%

-0.4%

-0.5%

June

1.4%

0.4%

0.9%

-0.5%

0.8%

July

0.1%

0.7%

1.4%

-0.1%

1%

August

1.6%

2.5%

2.4%

-0.1%

1.9%

September

3.9%

4.4%

3%

2.5%

3.3%

October (10 days)

8.4%

15.1%

14.8%

9.3%

11.5%

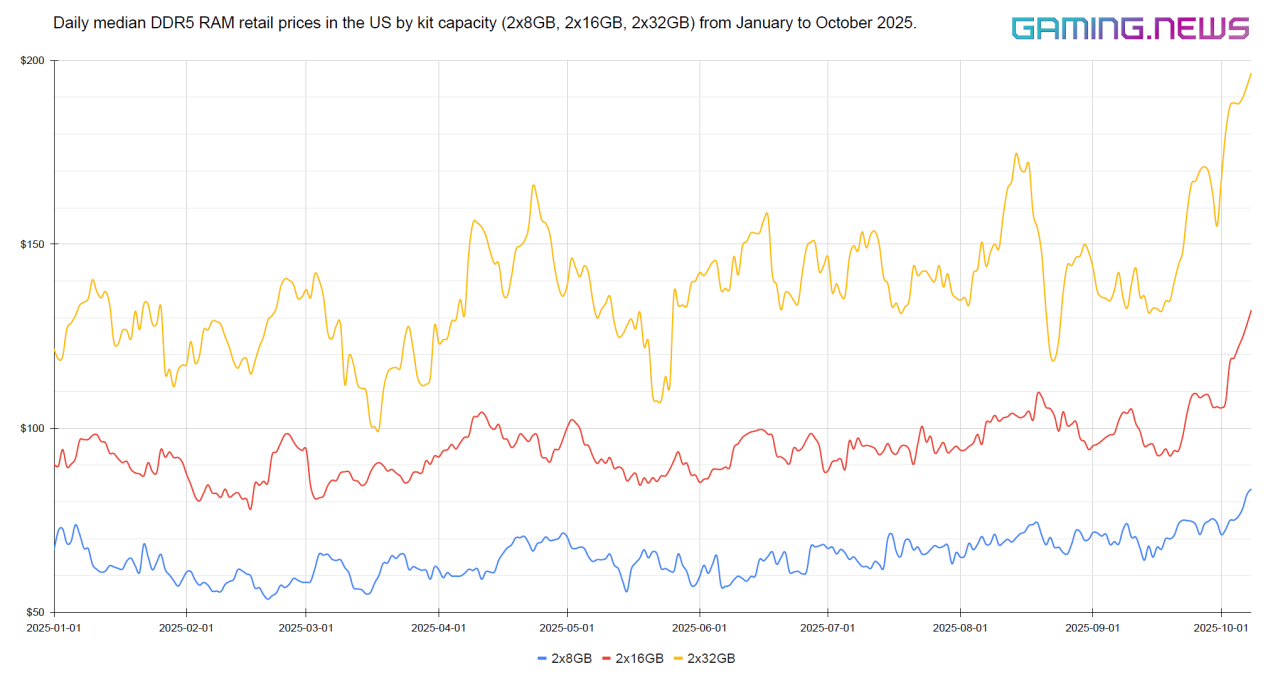

Daily median DDR5 RAM retail prices in US, 2025

Despite trimming, 2×32GB remains very volatile due to the highest promo activity. October 9-10 are excluded for now.

No separate lines are provided for 2×48GB and 2×64GB kits because, as said earlier, the samples are smaller compared to other models. We also do not plot a merged “2×48GB+” because capacities fall into different price bands, despite a similar trend, and a combined daily line would be too volatile and make no sense.

Key points:

- Once again, the October spike is clearly visible, and the April spike lines up with tariff news.

- On January 1, a DDR5 RAM 2×8GB kit cost $67, a 2×16GB kit $90.20, and a 2×32GB kit $121.60.

- On July 1, a 2×8GB kit cost $67.30, a 2×16GB kit $88.50, and a 2×32GB kit $146.60.

- Lowest daily median price for 2×8GB kit: $53.50 on February 20.

- Highest daily median price for 2×8GB kit: $83.50 on October 8.

- Lowest daily median price for 2×16GB kit: $78 on February 16.

- Highest daily median price for 2×16GB kit: $132.10 on October 8.

- Lowest daily median price for 2×32GB kit: $99.70 on March 18.

- Highest daily median price for 2×32GB kit: $196.50 on October 8.

- The whole table is too long to display here, sorry.

Why are the prices for PC memory rapidly rising?

The main driver for rising memory costs is AI. We track new AI hardware deals, which occur almost daily at this rate, and those deals absorb DRAM budgets and HBM capacity, which tightens supply for the whole market.

- Nvidia to invest $2B in xAI to lock a $20B deal for its own GPUs.

- Nvidia moved to invest $5 billion in Intel CPUs.

- OpenAI signed a fresh GPU supply deal with AMD.

- Nvidia intends to invest up to $100 billion in OpenAI.

Suppliers prioritize servers and HBM, contract quotes rise, and retail follows. Several analysts now call a DRAM supercycle through 2027. A supercycle refers to a situation where demand consistently exceeds supply over an extended period, causing constant price hikes.

Also, we did not include separate charts or tables, but a smaller European (Germany and the Netherlands) cut of data shows the same DDR5 RAM prices picture with a giant October spike.

Rising hardware prices: What’s next?

The last memory supercycle in 2017/18 ended with consumer RAM roughly doubling in price within a year; we will cover this story in a separate article soon, so you can better understand what’s to come.

And, if you plan a PC upgrade, waiting likely means paying more. The increases will not stop at components: as OEM contracts expire, consumer devices that use memory will move up in price or ship with less capacity (spoiler: they all use memory). There is little good news in the near term.

In the next article, we will look at storage prices.

Methodology

The primary source of raw data is the Keepa API. The dataset covers 250+ distinct DDR5 kits, excluding second-hand and merging duplicates, without preference for specific manufacturers. Data cannot be reversed to individual ASIN listings.

Daily prices were calculated using a rolling median. We used the median instead of the average because, even after removing extreme highs and lows, the mean result remained too volatile. Using the median also lets us combine clock bins and simplify processing, while the result better reflects shelf prices than the average method. The sample size keeps the results representative, and the charts are clearer.

MoM compares the month of October to date (through October 10) with full September medians, and will be updated later. Final values will be higher.