Gaming Deals Hit $12.1 Billion in Early 2025 Amid Waning Interest from Private Investors

|

|

Key points

- The first quarter of 2025 saw $12.1 billion in gaming-related transactions, with a 120% year-over-year increase.

- From January through March, the number of transactions dropped from 167 to 135 compared to the same period in 2024.

- The biggest in the mobile sector was Scopely’s $3.5 billion acquisition of Niantic’s gaming division.

According to a report from Aream & Co., the first quarter of 2025 saw gaming-related transactions reach a massive $12.1 billion, up 120% year-over-year, even though fewer deals were made in comparison with the same period of 2024.

From January through March, the number of transactions dropped from 167 to 135 compared to the same period in 2024. But the deals were bigger and mostly focused on mobile.

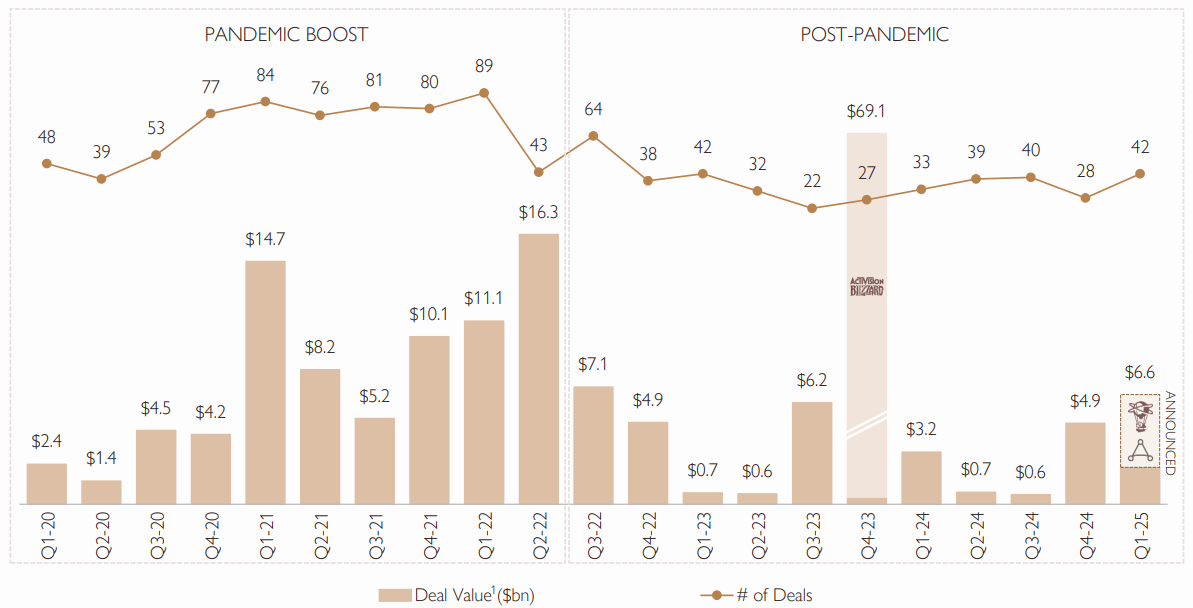

The mergers and acquisitions front alone accounted for $6.6 billion across 42 deals, featuring the highest M&A activity since Q3 2022. The biggest deals were in the mobile sector: Scopely’s $3.5 billion acquisition of Niantic’s gaming division topped the chart, followed by Miniclip’s $1.2 billion purchase of puzzle game maker Easybrain. AppLovin sold off its gaming studios for $900 million to an undisclosed buyer, while Modern Times Group acquired Plarium studio behind RAID: Shadow Legends for $620 million.

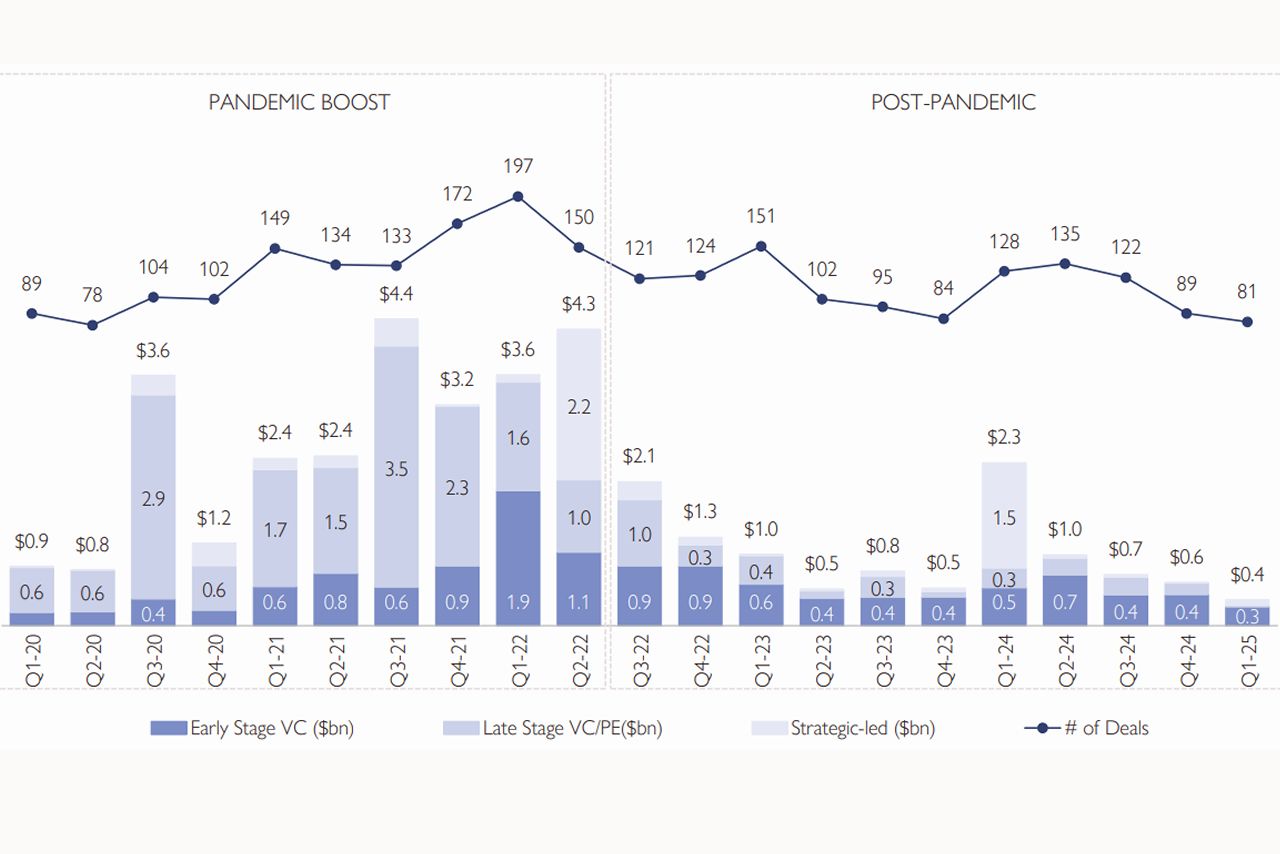

Private investment, on the other hand, hit a serious slump. Only 81 investments were made. It is the lowest figure since Q2 2020, with total funding scraping together just $400 million. The largest round went to Niantic’s AR-focused spinoff, Niantic Spatial, which raised $50 million from Scopely.

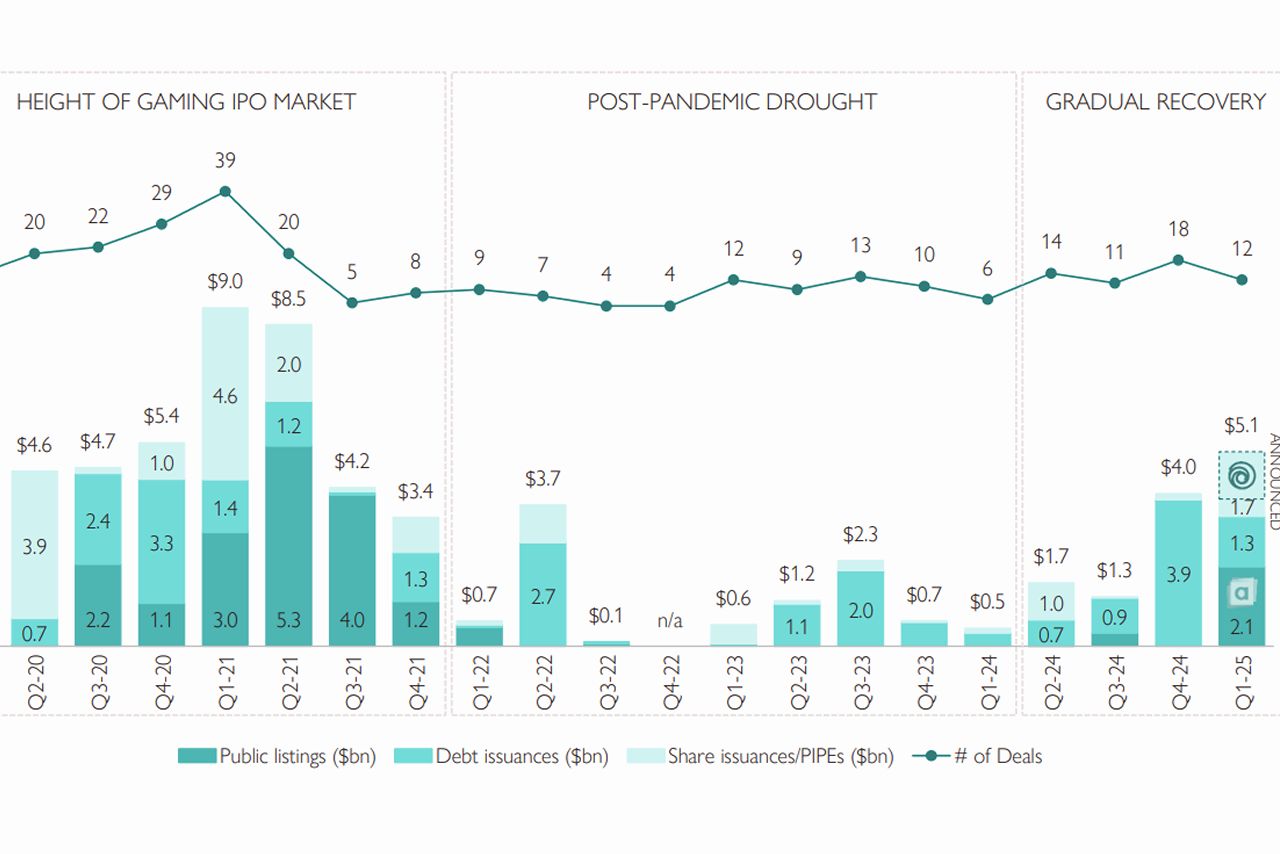

As for the public listings, the number of IPOs and related market listings doubled compared to 2024, with 12 companies making moves worth a combined $5.1 billion. Asmodee, a subsidiary of Embracer Group, made the biggest debut by going public with a valuation of $2.1 billion. Tencent was also among the top with $1.25 billion totaling PIPE investments in Ubisoft’s new subsidiary.