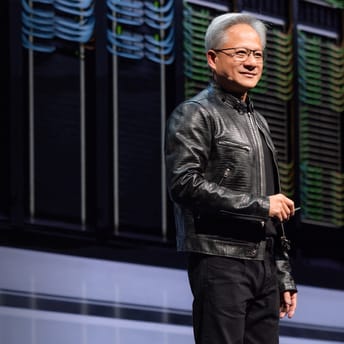

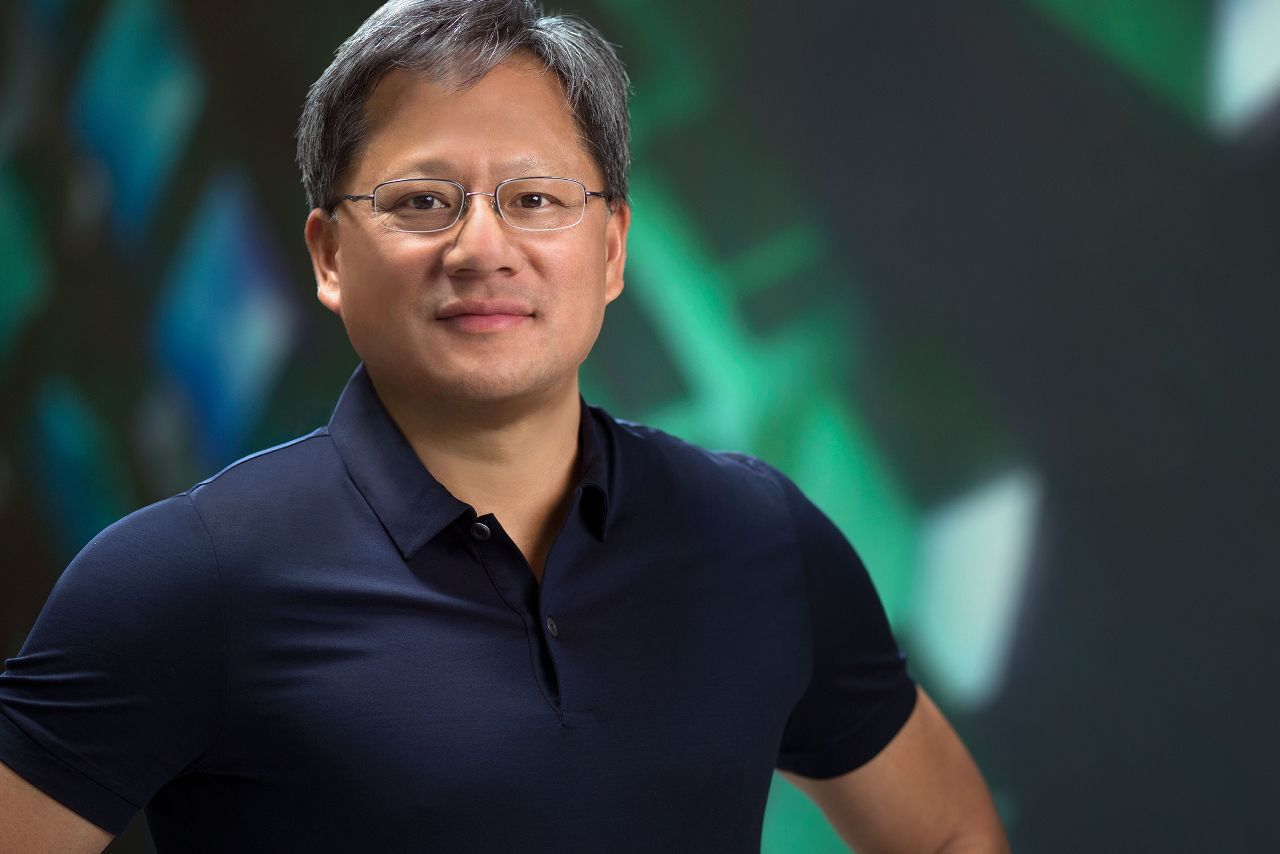

Nvidia Stock Rebounds Ahead of CEO’s Meeting With Trump

|

|

Key points

- Nvidia stock is recovering after unprecedented sell-off but remains down 11% for the week.

- CEO Jensen Huang is set to meet with Donald Trump, with AI chip exports and trade tariffs likely on the agenda.

- Nvidia remains a dominant force in AI and gaming hardware.

Nvidia shares are on track for a second consecutive day of gains, recovering from steep losses earlier in the week. However, the stock remains down 11% for the week, weighed down by growing competition from China’s DeepSeek AI and uncertainty in the AI investment landscape.

Reports indicate that Nvidia CEO Jensen Huang will meet with U.S. President Donald Trump on Friday, where key topics will likely include AI chip export restrictions and potential trade policies. Trump is also reportedly considering new tariffs on goods from Mexico, Canada, and China, which could have broad implications for Nvidia and the gaming industry, given the company’s critical role in GPU manufacturing.

On Monday, Nvidia suffered the largest single-day market capitalization loss in U.S. corporate history, shedding nearly $600 billion. This unprecedented decline was triggered by the announcement from China’s DeepSeek of an advanced AI model developed at a fraction of the typical cost, raising concerns about future demand for Nvidia’s high-priced AI chips, sparking fears about U.S. dominance in AI technology and causing a $1 trillion sell-off across major tech stocks.

Amidst this turmoil, the U.S. Commerce Department has launched an investigation into whether DeepSeek illegally obtained restricted Nvidia chips through smuggling networks operating out of Malaysia, Singapore, and the United Arab Emirates. Current U.S. restrictions prevent Nvidia’s most advanced AI processors from being shipped to China. Neither the Commerce Department nor DeepSeek have commented on the matter.

Despite regulatory concerns, Nvidia remains a dominant force in AI and gaming hardware. Nvidia’s latest RTX 50xx graphics cards have sold out instantly upon release, with retailers reporting dwindling stocks and rising prices due to limited availability. The overwhelming demand underscores Nvidia’s strong foothold in the gaming market, even as the company faces increasing competition in the AI sector.