Microsoft Allegedly Considered Shutting Down Xbox Before Acquisition of Bethesda and Activision

|

|

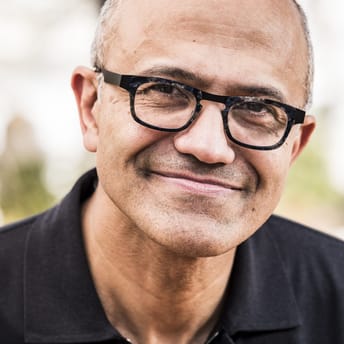

- Microsoft CEO Satya Nadella was thinking about shutting down the entire Microsoft’s Xbox division.

- Up to February 2024, Game Pass had 34 million subscribers.

- Microsoft purchased Bethesda for Bethesda for $7 billion and Activision Blizzard for $75.4 billion.

Microsoft CEO Satya Nadella reportedly debated shutting down the entire Xbox division to avoid major acquisitions but ultimately decided on purchasing Bethesda for $7 billion in 2021 and Activision Blizzard for $75.4 billion in 2023.

As reported, primarily the company’s redefined gaming strategy led to significant investment in gaming through acquisitions to expand the number of players with gamers dedicated to Blizzard’s and Bethesda’s games.

Faced with slow growth in its nascent Game Pass subscription service, Nadella was presented with two stark options: bolster the Xbox division through major studio acquisitions or phase it out. “Nadella told two people at the time that the company could either acquire major game studios to drive more subscriptions… or it could wind down its games business entirely,” the report reveals.

The acquisitions of Bethesda and Activision Blizzard were seen as critical lifelines for Xbox, ensuring its survival and laying a great groundwork for its ambitious goals.

Despite the investments, challenges remain for the gaming giant. Game Pass, which up to Microsoft reports from February 2024, has 34 million subscribers, is still far from Microsoft’s target of over 100 million subscribers by 2030.

Microsoft’s flagship subscription service offers players access to a vast library of games for a monthly fee. However, Microsoft has struggled to convince several game studios to bring their titles to the platform. Developers are reportedly hesitant to embrace the subscription model, even with fees offered by Microsoft. “The majority of the game market doesn’t really want a Game Pass,” said Gus Zinn, portfolio manager at the Macquarie Science and Technology Fund. This sentiment echoes broader concerns that Game Pass may not align with the traditional purchasing habits of most gamers.

The $75.4 billion acquisition of Activision Blizzard was expected to be a game-changer, bringing blockbuster franchises like Call of Duty to the Game Pass ecosystem. However, integration has proven challenging. Activision still relies heavily on its own servers and services like Google Cloud and Amazon Web Services rather than Microsoft’s Azure cloud platform, creating hurdles in achieving full synergy between the companies.

The report also highlights Microsoft’s internal recalibration regarding Game Pass metrics. Late last year, the company removed Game Pass growth as a key performance indicator tied to Nadella’s compensation after failing to meet subscriber growth targets for two consecutive years.

Despite these challenges, Xbox remains committed to a multi-platform approach. Microsoft has hinted at bringing exclusives like Halo and Gears of War to non-Xbox platforms, signaling a shift toward accessibility and choice over strict platform exclusivity.