Web3 Gaming: Natural Evolution of Real-Money Trading in Games

|

|

Web3 gaming didn’t emerge in a vacuum—video games have long since evolved from a niche hobby into full-fledged digital economies. As early as the late 1990s, some Ultima Online and EverQuest players weren’t just trading items and slaying monsters: they had used eBay and were getting hundreds of dollars for epic drops or carry services. In rare cases, it even became their full-time job.

In the 2000s, the scale expanded dramatically. The phenomenon of gold farming emerged: thousands of people spent their working days in MMOs (mostly WoW and EVE Online), grinding in-game currency or resources to sell for real-world money. Studies estimated the real-money trading (RMT) market for games at over $2 billion by 2007.

In other words, the idea of monetizing time spent on computer games appeared long before blockchain. What Web3 gaming really does is formalize and legitimize what players have already been doing on grey markets for two decades: trading virtual assets, which today take the form of tokens that can move freely between platforms. So, let’s explore what predated NFTs in games and how it all began.

Early RMT, Grey Markets

The earliest P2P transactions emerged around 1997-2000. In Ultima Online and EverQuest, the first farmers and eBay auctions appear. At the same time, shady trading practices like lowballing and flipping shifted from purely in-game economies to real-money trades. No one could stop you from buying low and selling high (absence of regulations). If you could spot undervalued loot on a forum or auction site, you could profit in fiat just as easily as in gold.

Stabilization of the virtual economy

Game worlds weren’t immune to inflation, and RMT only made it worse. Over time, players started looking for alternatives to in-game gold: something that held value better, with a clearer link between time spent and reward earned.

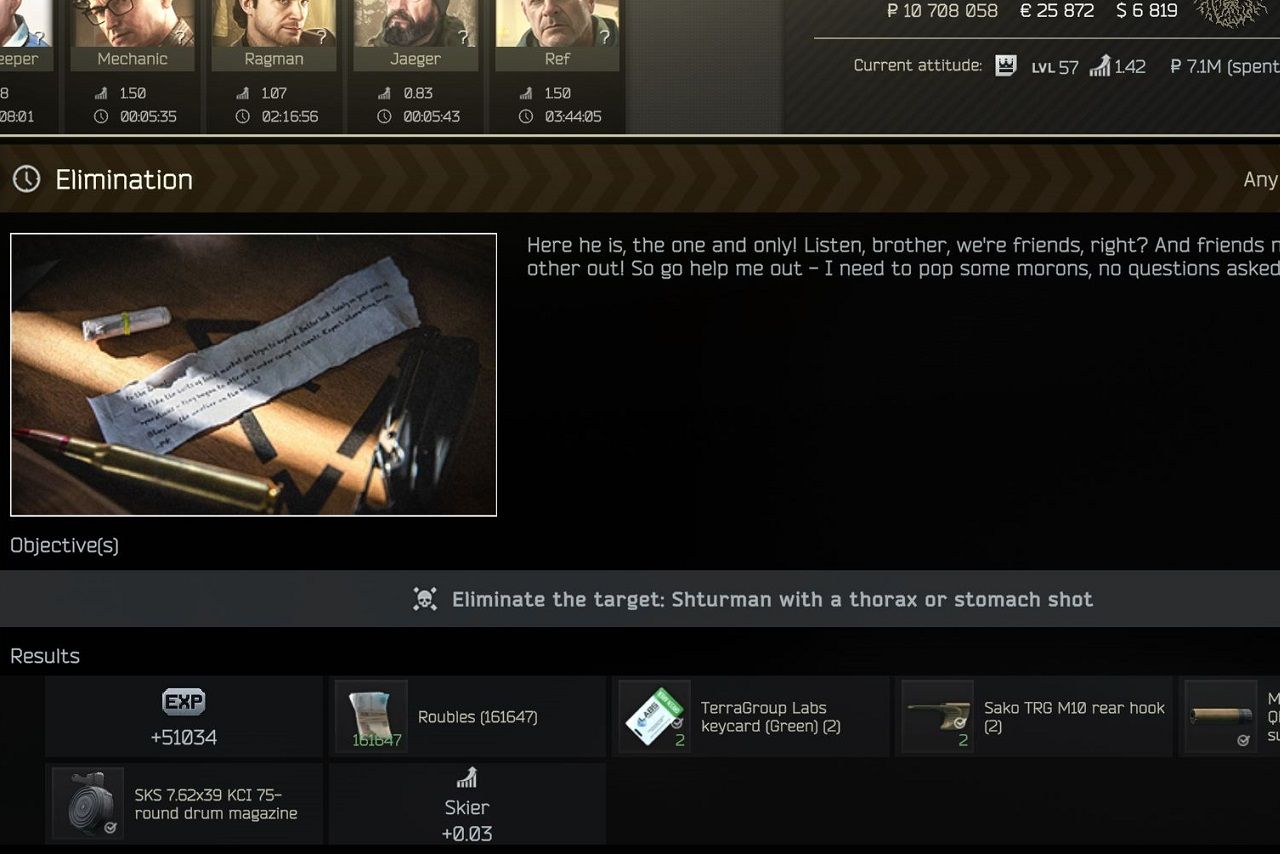

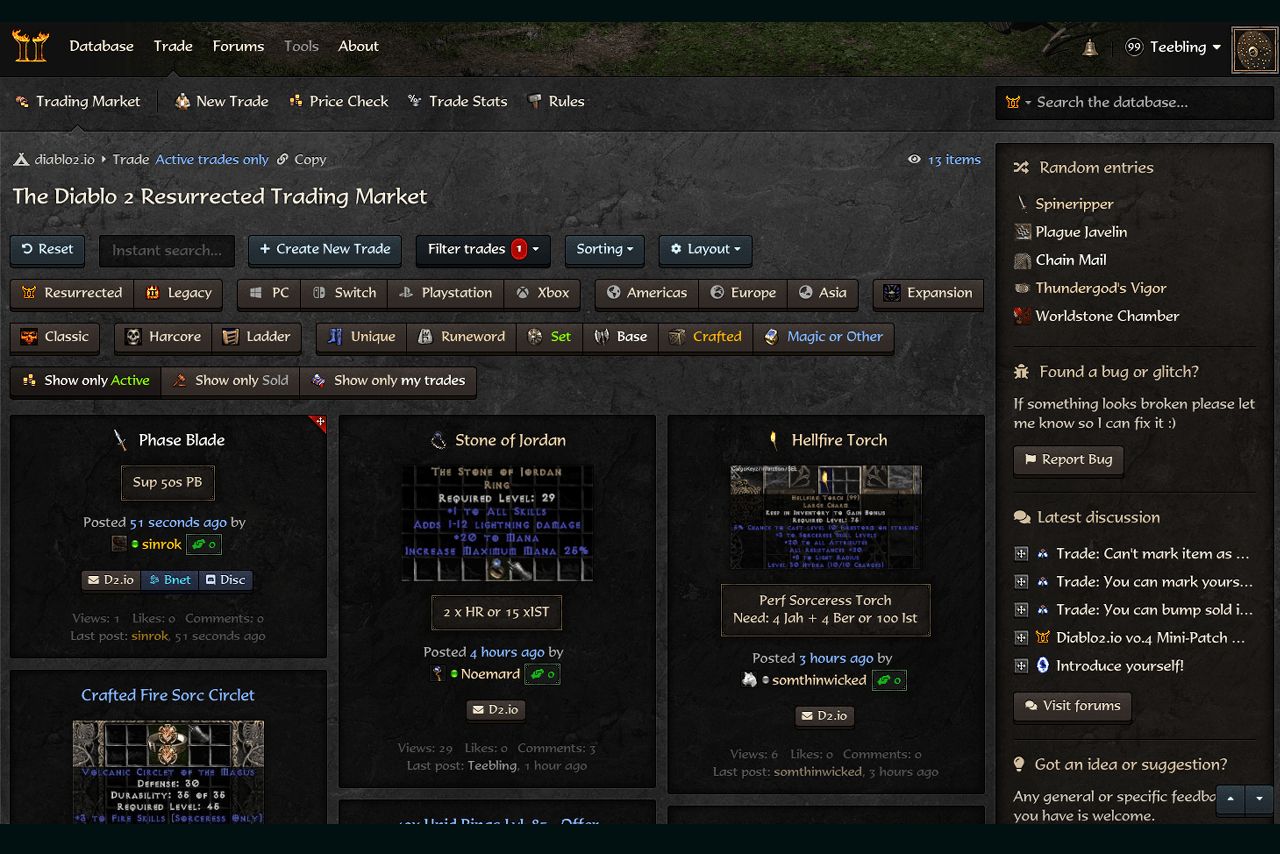

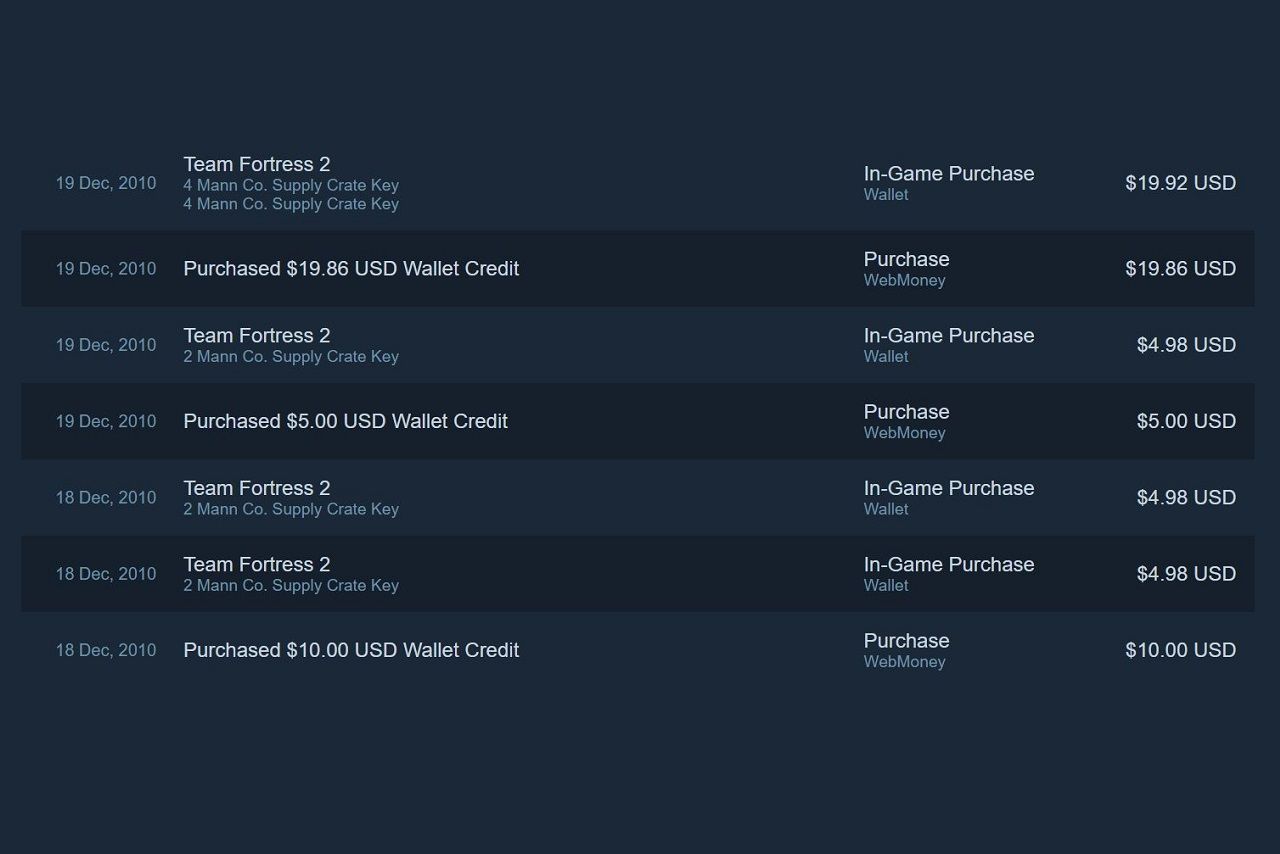

Perhaps the most telling example was Diablo II: The Stone of Jordan (SoJ) unique rings, and, later (with the release of the Lord of Destruction expansion), high runes became the community’s hard currency. The Diablo economy was also largely shaped by item duplication (duping), which accelerated inflation, but that’s a story for a whole new article. What’s funny is that even in 2025, Diablo IV’s market is still driven by dupes. Returning to the main theme, a later (2009/10) but popular case is Team Fortress 2, where Refined Metal (ref) evolved into a widely accepted trade currency. It was only logical that RMT moved toward more stable game currencies as well.

RMT market expansion

The rise of MMOs drove rapid market expansion. World of Warcraft, RuneScape, EVE Online, and other MMOs gave rise to industrial-scale farming operations—entire guilds and corps created solely for this purpose. Up to 1 million farmers worldwide, with an estimated market size is more than $2 billion by 2007.

Early regulatory response to RMT

RMT is banned in most games, but that rarely stops anyone. Punishments are slow and ineffective; you can always create a new account. The real problems began when third-party marketplaces got involved. In 2007, eBay banned the sale of virtual goods. This move was triggered by legal concerns from publishers and IP ownership issues, and also due to rising scams (the most common being PayPal chargebacks after receiving in-game goods), which placed a heavy burden on customer support.

Summary of pre-blockchain markets

- Trust via third-party platforms. Most deals took place on eBay, forums, and IRC channels. Fraud risk was high: accounts were often sold, then reclaimed via password reset after payment, for example.

- Internal currency ecosystems. When official gold lost value (due to inflation), players turned to scarcer in-game resources. In Diablo II, there were SoJ rings and high runes. In WoW, for some time, the economy was anchored to epic mounts.

- Conflict with publishers. Developers actively fought RMT by banning traders and closing auction activity on official forums. eBay’s 2007 ban marked the peak of this struggle, but demand didn’t disappear.

- Lack of real-world liquidity. Even legal in-game stores didn’t support fiat withdrawals. Players could spend real money, but couldn’t take it back out—everything stayed inside the publisher’s ecosystem.

The market had already proven players were willing to pay for digital labor, but it suffered from a lack of transparency, high fraud risk, and total publisher control. Web3 gaming doesn’t reinvent the wheel—it solves these long-standing problems with verifiable scarcity, decentralized ownership, and trustless transactions. It’s a logical evolution of RMT.

Web2 Moves to Legalize RMT

As the grey RMT market grew into a multi-billion-dollar economy, some companies chose to fold item trading into their own services rather than fight it.

The longest-running example is Second Life. In 2003, its creators opened the LindeX exchange, letting residents convert Linden Dollars to U.S. dollars through PayPal. By the virtual world’s tenth anniversary, users had moved more than $3.2 billion in total and were averaging 1.2 million trades a day.

Blizzard tried something bolder. On 12 June 2012, Diablo III launched a Real-Money Auction House. Players could list weapons and armour for cash, Blizzard took a one-dollar cut per item (or 15 percent on stackables) and another 15 percent on withdrawals. Less than two years later, production director John Hight admitted the system had gutted the thrill of the main gameplay loop; Blizzard closed the RMAH on 18 March 2014.

Valve went a different route with the Steam Community Market. Beginning in December 2012 with Team Fortress 2 and later expanding to CS2 and Dota 2, the market let users trade cosmetic items while Valve collected a 5 percent platform fee, and developers could add up to 10 percent more. Earnings, however, never left Steam Wallets, locking value inside Valve’s ecosystem.

The Web2 takeaway is blunt: even an official storefront leaves assets at the mercy of a single company. Fees can rise, terms can change, or the market can vanish overnight, turning hard-won gear and potential profits into digital pumpkins.

Early On-Chain Experiments

Late 2017 marked a break point when CryptoKitties showed that an in-game asset could simply be a token. Demand for cartoon cats quickly filled a quarter of Ethereum’s bandwidth and slowed the network to a crawl, proving both appeal and strain in one stroke.

ERC-721, finalised in January 2018, supplied the missing piece: a common format for non-fungible tokens that any wallet or marketplace could recognise without custom code. With that in place, the first generation of blockchain games took shape. Gods Unchained sold more than four million NFT cards and raised $15 million before launch, demonstrating that on-chain items could trade as easily as Magic: The Gathering singles.

The same lesson resurfaced in 2022 when Sunflower Farmers, a modest farming game on Polygon, clogged the network during a rush of transactions, underlining both potential and pressure.

What’s different from Web2 stores?

- Ownership is real: the NFT sits in the player’s wallet, beyond the reach of a studio ban.

- Withdrawals are open: decentralised exchanges let users cash out without a platform gatekeeper.

- Portability is native: a standard such as ERC-721 lets an item appear in more than one game instead of being trapped inside a single database.

Early Web3 versions still had rough edges. Wallet setup and gas fees turned newcomers away, token-first economies like Axie Infinity wrestled with inflation, while some others were orchestrating rug pulls. Moreover, major breaches (most obviously, the 2022 Ronin hack) highlighted the need for constant security reviews.

Yet one gain proved decisive: cryptographically verifiable, developer-independent ownership. Every later advance (play-to-own loops, near-zero-fee Layer 2s, portable identity) builds on that foundation.

Rise and Collapse of Play-to-Earn

In the summer of 2021, a surging crypto market and pandemic lockdowns sparked a new promise: earn money just by playing. Axie Infinity became the banner title. Priori Data counted 2.7 million daily active users by January 2022 (more than Destiny 2 and Warframe combined, for example).

A large share of those players came from developing regions. In East Asia, for example, an Axie farmer could clear up to $2,000 a month, well above the local average wage. Instead of traditional VC funds, some guilds bought teams of Axies as capital assets and hired players to grind tokens in return for a revenue split.

The system needed a steady flow of newcomers to stay afloat. By March 2022, the price of SLP, Axie’s reward token, had slid down, and following that, daily users fell to roughly 1.5 million. The decline accelerated after the largest hack in gaming history: on 23 March 2022, attackers drained 173,600 ETH and 25.5 million USDC (about $625 million) from the Ronin bridge.

The events of 2022 were a sobering lesson. play-to-earn turned into a warning label: unchecked token inflation ruined game balance, regulators began treating in-game earnings as potential unregistered securities, and players grew wary of any Web3 project, despite the groundbreaking ideas and potential involved. The industry was forced to concede that lasting success depends on putting the gameplay (and not the payout) at the game’s core.

Pivot to Play-to-Own

After play-to-earn lost steam, studios reframed the pitch: earning became a side benefit, while true digital ownership took center stage. Three developments made the pivot unmistakable.

AAA publishers return to Web3

- Ubisoft revived its blockchain effort in October 2024 with Champions Tactics: Grimoria Chronicles on the Oasys network (its first fully realised NFT title after the short-lived blockchain-based NFTs for Ghost Recon Breakpoint).

- Square Enix followed suit, auctioning 1,500 NFT characters for the story-driven Symbiogenesis in mid-2024; the entire run sold out immediately.

- Epic Games, meanwhile, opened its store to blockchain releases. Illuvium arrived there in November 2023, shortly after Gala Games’ Web3 western battle-royale Grit.

Infrastructure ready for mass market

Immutable brought its zkEVM mainnet online in January 2024. By year-end, 440 studios had signed on, drawn by low fees and EVM compatibility. Flagship projects like Gods Unchained began migrating to cut gas costs and unlock richer smart-contract features.

BNB Chain launched Greenfield (a decentralised storage layer) in October 2023. Assets and user-generated content can now live off studio servers while remaining accessible to BSC and opBNB contracts. Taken together, these upgrades push the Web3 experience closer to Web2’s one-click ease.

Reliable metrics appear

Helika’s 2024 report showed average revenue per paying user in Web3 games running at roughly double that of traditional free-to-play. The same study found that 65 percent of on-chain titles fall into RPG, casual, or action-strategy genres, evidence that core gameplay, not speculation, is driving in-game spending.

On this foundation, play-to-earn keeps fading. Tokens remain part of the mix, but studios now measure success by lifetime value and retention rather than token price. By 2025, the prevailing model is play-to-own, a stance better equipped to support interoperable economies in the cycle ahead.

2025: Web3 Gaming Replaces GameFi

By mid-2025, almost no one in the industry used the term “GameFi”. It had become a reminder of the play-to-earn boom-and-bust cycle: runaway rewards, broken economies, and disappointed players. Web3 gaming took its place, shifting attention back to the essentials: owning digital assets and moving them across multiple games and platforms.

Ownership as a service

In May 2025, Ubisoft deployed a cross-chain verification layer on top of LayerZero. Skins and cards can now transfer among more than 130 blockchains, including Ethereum and Solana. LayerZero supplies routing and cryptographic proofs, while Ubisoft keeps the hand-off seamless inside its games. It is the first production-scale, cross-chain inventory from a major AAA publisher.

New standards, new possibilities

April 2025 saw NTT Docomo release GT6551, a racing title built on ERC-6551. Each NFT car behaves like a self-contained wallet that holds wheels, engines, and paint jobs. Players swap parts directly on-chain; no central inventory server is required. The result is fine-grained, player-driven customisation that can persist beyond any single game.

NFTs are becoming infrastructure

Coin World reported that overall NFT trading volume fell 24 percent in Q1 2025, yet transaction count dropped only 10 percent. Big speculative flips are fading, but everyday use remains steady. NFTs are now serving as access keys, player IDs, and data containers for in-game AI, not just as collectibles.

New metrics, new mindset

Studios gauge success with DAU-to-MAU ratios, lifetime value, and cohort retention, not token presales or floor prices. A 2025 Web3 game looks and plays like a standard free-to-play title, but it carries an optional, fully fledged economy in the background. Earning is a reward for meaningful contribution, not the product itself.

Web3 Gaming Isn’t Separate—It’s RMT 2.0

History shows the demand was always there. When eBay banned trading of virtual goods in 2007 under publisher pressure, real-money trading was already worth hundreds of millions of dollars. Players paid not just for bragging rights, but to save time and gain real in-game advantages.

Various MMORPGs’ grey markets proved that in-game hours could be converted into cash. Diablo III’s Real-Money Auction House later showed that the trade could be legalised, yet as long as items lived on studio servers, control stayed with the publisher. Blockchain adds the missing layer: cryptographic ownership, turning secondary sales into a transparent revenue stream for both sides.

Web3 gaming key takeaways on RMT

- Trust. Smart contracts lock in ownership, so a buyer no longer risks losing the item after a PayPal transfer.

- Portability. Assets are not trapped in a single title; players can use, trade, or stake them wherever standards are supported.

- Transparency. Every transfer is on-chain, making dupes and fraud easy to audit.

- Developers finally earn from resales. Under the old grey-market model, they saw none of the proceeds; with Web3, royalties are baked into the contract and arrive automatically.

- Players move from customers to stakeholders. In DAO-driven projects, they can hold governance tokens, vote on features, and fund development, turning farmers into backers.

Web3 didn’t invent monetised play; it supplied verifiable ownership, open accounting, and revenue sharing. By 2025, the question is no longer whether players can profit, but who sets the rules for that economy.

Viewed across two decades—from gold-farming rings to cross-chain inventories—Web3 gaming is less a separate industry than the next chapter in digital commerce. The space is still early and closely watched, yet the principle it rests on—digital property has real value even in games—has already reshaped expectations.