Nvidia and AMD may cut budget gaming GPUs amid AI boom

|

|

Key points

- AMD has reportedly informed partners of imminent price increases across its GPU lineup due to higher graphics memory costs.

- Hardware industry reports say AMD and Nvidia may cut some budget gaming GPUs as VRAM costs make them unprofitable.

- Board partners are considering trimming VRAM configurations on future gaming graphics cards to keep costs in check.

AMD has reportedly notified its board partners that GPU prices will increase very soon across all models, including gaming Radeon models, as graphics card memory costs spike in the wake of the new AI-driven DRAM supercycle.

At the same time, Korean hardware industry reports claim that both AMD and Nvidia are weighing more drastic options, including cutting or cancelling some budget and mid-range gaming GPUs, because surging memory prices are making those graphics cards unprofitable.

Rising gaming GPU production costs

AMD’s internal notice, reported via channels of its Chinese hardware board partners, describes imminent GPU price increases. The company is said to be raising shipment prices across the whole model lineup because memory procurement costs have risen sharply, with the hike expected to apply to consumer Radeon graphics cards as well as workstation and AI products.

The exact increase and timing are not yet publicly known, but the following GPU shipments to board partners are expected to carry significantly higher prices.

For now, this applies only at the partner level, but new MSRPs are expected, since AIB partners are unlikely to absorb all increases so that the hikes will be passed on to consumers. Board makers and OEMs will decide how much of the higher bill to pass through to retail pricing, while older inventory bought at previous rates and upcoming sales can temporarily soften the impact.

Potential GPU model cuts and VRAM downgrades

The Korea Economic Daily describes a more severe scenario that goes beyond GPU price hikes. According to the report, both AMD and Nvidia are weighing the option to discontinue some mid-range and entry-level gaming GPUs if GDDR VRAM ends up accounting for too large a share of the bill of materials.

Even without cutting models, a price hike on budget options is projected to be significant. GPUs like the AMD Radeon RX 9060 XT or Nvidia GeForce RTX 5060 could be at risk, since budget buyers are more sensitive to a 15-30% price increase on an entry-level $300 GPU than to a similar jump for a $1000 high-end graphics card targeting enthusiasts.

The same report says OEMs (Asus, specifically) are already considering lower-memory configurations and fewer GPU models, where inflated VRAM pricing is still acceptable, which could repeat the limited choice and poor value seen during the GPU crypto mining era.

Neither AMD nor Nvidia has announced recommended price changes or specific product cancellations, so the possibility of budget and mid-range SKUs being canceled remains a rumor, even if supported by well-known hardware industry insiders, media, and statistics.

Taken together with the confirmed DRAM supercycle and AMD’s reported partner notices, new graphics cards are to become more expensive to manufacture, and maintaining affordable gaming GPUs will become unprofitable for corporations.

Memory costs threaten Nvidia RTX 50 Super refresh

Earlier, we reported that several hardware insiders had shared information about a potential RTX 50-series Super refresh. While their details differed, they all agreed that the launch was being pushed back, prices could end up higher than expected, and VRAM configurations might be reduced.

All this is a result of a broader DRAM supercycle that we track in our ongoing coverage of rising PC hardware prices. The current memory hikes have already moved from DDR5 RAM into other PC components and consumer devices and are likely to affect laptops, consoles, and handhelds next.

Gaming GPUs are no longer core market for Nvidia and AMD

Nvidia’s gaming GPUs are a secondary business line next to data center hardware. In the recent fiscal declaration, Nvidia reported $57.0 billion in total revenue, with $51.2 billion from Data Center and $4.3 billion from Gaming. The company’s largest revenue driver is business AI and server GPUs, not consumer GeForce sales.

AMD’s revenue overview shows the same direction. In Q3 2025, AMD posted $4.3 billion from its Data Center segment and $4.0 billion from Client and Gaming combined. The Gaming sub-segment was $1.3 billion, and AMD attributed that growth to custom console chips plus Radeon models, so discrete GPUs are only part of the category.

The memory market serving AI and servers uses the same supply base as the consumer VRAM. Recent reporting shows AI data center demand driving a DRAM undersupply and sharp contract price increases, with record low inventories and suppliers prioritizing high-margin HBM and server parts.

As memory prices rise across vendors, graphics memory costs grow alongside, lifting the bill of materials for new gaming GPUs from both AMD and Nvidia.

Rising PC gaming hardware prices

The partner warning about higher GPU prices aligns with the ongoing memory price surge already affecting consumer parts; prices are climbing across PC hardware and adjacent devices. RAM and storage are under direct pressure from AI data centers. Supply of core components trails demand, so manufacturers raise contract prices, and higher costs flow through OEMs and into retail.

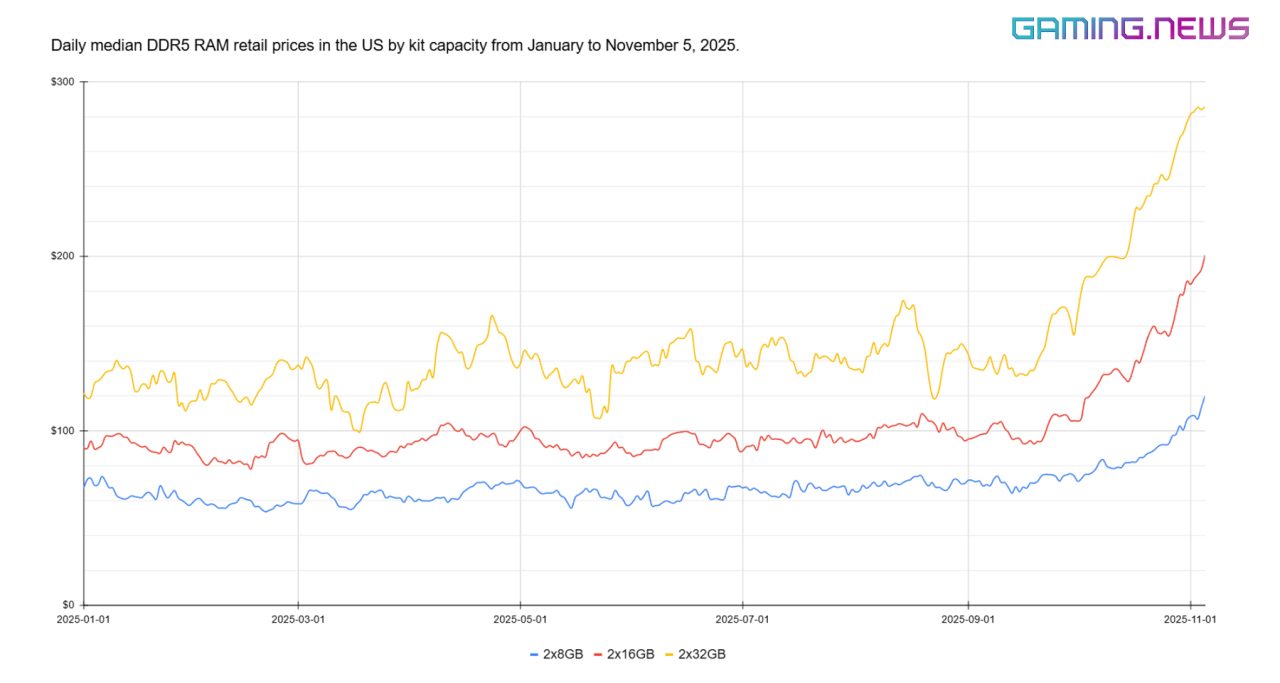

Board partners now face higher bills of materials, while tariffs add further volatility. As a result, retail prices for modern RAM kits have doubled over the past year, and other memory-bound hardware is starting to follow.

Our latest snapshot shows DDR5 kit prices in US retail at a historic high. The median price for 2×32 GB kits has moved above $200, while 2×16 GB kits are above $120. Over about a month, median prices rose around 40% across the PC RAM market, and 2×32 GB kits climbed 70% in six weeks, with momentum building from late September into early November.

These are median retail figures across multiple stores and brands, so they reflect a broad repricing of mainstream consumer DDR5 RAM kits.

What is DRAM supercycle?

The previous DRAM supercycle in 2017 followed a simple pattern. Demand for memory in smartphones and data centers remained ahead of supply for multiple quarters, while suppliers focused capacity on higher-value parts.

Contract and spot prices increased for months, and retail DDR4 RAM kit prices roughly doubled over the course of a year. Only after inventories were rebuilt in late 2018 and through 2019 did prices retrace.

Analysts now point to a new memory supercycle that may peak around 2027. By late Q3 2025, DRAM inventories had fallen to about three weeks of supply. Vendors are channeling available capacity into AI demand.

Major DRAM manufacturers (Samsung, Micron, and SK hynix) have raised contract prices multiple times this year, with recent rounds in the 15-30% range. Over the same period, all three have reported record or near-record profits.

These increases have already reached consumers through higher RAM prices, producing a multi-quarter uptrend with potential shortages that could run well into 2026 before easing.

Industry warnings on the memory crisis

Memory makers are not signalling quick relief. Micron expects tight DRAM conditions to persist through 2026. Adata chairman Simon Chen says AI customers are outbidding the consumer PC market, upstream inventory has dropped to roughly two to three weeks, and his teams were instructed to sell cautiously and prioritise long-term clients.

Issues are beginning to surface in other consumer devices. Xiaomi has warned that rising memory costs are pushing smartphone prices higher and adjusted Redmi K90 launch pricing, then briefly discounted the 12/512 GB variant after consumer pushback. Memory inflation is flowing into retail pricing faster than many buyers expect.

Why are hardware prices rising?

Prices are rising because AI demand is consuming most of the available memory, limiting capacity for other segments. When fabs run near full utilisation, suppliers raise contract prices, partners adjust their own pricing, and retail follows as new inventory arrives at a higher cost.

Until new fabrication capacity comes online or AI demand normalises, this pressure persists, and RAM or SSD shortages can appear alongside further price increases.

Recent multi-billion-dollar hardware deals and long-term supply agreements in the AI sector lock in even more capacity:

- Nvidia plans to invest up to $100 billion in OpenAI and deliver about 10 GW of AI GPUs to data centers.

- Nvidia will invest $2 billion in xAI to secure an estimated $20 billion AI accelerator deal.

- Nvidia has committed around $5 billion to Intel for AI hardware development.

- OpenAI has signed a new GPU supply deal with AMD.

- OpenAI and Broadcom have agreed on 10 GW of custom AI accelerators.

Tariffs add to hardware costs

Tariffs are adding a separate cost driver on top of memory hikes. In 2025, Nvidia has already moved to cushion tariff exposure, with channel reports pointing to price increases across most product lines, reportedly including low-double-digit lift on GeForce GPUs.

Looking ahead to 2026, TSMC is expected to raise foundry prices for advanced nodes by about 5-10% in response to US tariff pressure, which would increase silicon costs for new AMD and Nvidia GPUs fabricated on those processes.

A draft US policy discussed in late September goes further, proposing up to 100% semiconductor import tariffs for companies that do not meet a domestic production ratio, keeping tariff risk elevated and adding a premium to final prices even without a finalized timeline.

For board partners, tariffs and memory inflation stack. When GDDR contracts rise, VRAM becomes a larger part of the GPU bill of materials. If the same memory or the finished cards face higher import costs in the US, partners pay more again on landing. The result is a double increase in new cards: higher VRAM costs from the memory market and higher silicon or import costs from tariffs, which raise the floor for future MSRPs across gaming GPUs.

Summary: Gaming GPUs will become more expensive

GPU manufacturing costs are rising because the same memory shortage that raised DDR5 RAM prices is now driving up VRAM prices. Those higher costs are likely to be passed on to consumers.

If AMD’s shipment hike proceeds, the subsequent Radeon GPU batches land with higher VRAM costs, and board partners will reprice new stock in retail as older inventory clears. With memory taking a larger share of build cost, budget and mid-range gaming GPUs are becoming unprofitable to make, leaving vendors to raise MSRPs or reduce VRAM configurations.

Other, more drastic options include axing budget gaming GPU lines. Korean industry reports say AMD and Nvidia are considering cutting some entry- and mid-range GPU models if rising VRAM costs keep squeezing margins. The idea is to drop the lowest-profit SKUs or ship fewer of them until memory pricing stabilizes.

The gaming hardware market is struggling amid an AI-driven hardware economy. Contract prices for memory and storage rise first, OEM build costs follow, and retail adjusts when replenishment comes in at the higher prices. DDR5 kits and SSDs have already repriced in US retail, and GPUs are now catching that same memory wave, with consoles, laptops, and prebuilts next in line if component costs keep climbing.

The memory crisis, driven by the DRAM supercycle, is caused by AI demand and supply allocation. Data centers are locking in DRAM and HBM capacity through long-term contracts, inventories remain tight, and suppliers continue to prioritise higher-margin server and AI memory over consumer volumes.

With memory contracts rising across categories and VRAM for gaming GPUs becoming more expensive, the cost pressure on new graphics cards is increasing right now. It will stay well into 2026 or longer, until supply expands or AI demand cools.