Nvidia GeForce RTX 50 Super refresh faces memory shortage

|

|

Key points

- GDDR7 shortage puts RTX 50 Super refresh under pressure, with rumors ranging from a half-year delay to cancellation.

- Leaked Super specs with 18-24 GB VRAM depended on 3 GB GDDR7 modules; reduced VRAM and higher prices are possible.

- The same memory pressure can lift MSRPs on existing Nvidia RTX 50-series GPUs, aligning with the ongoing DRAM upcycle.

A potential shortage of GDDR7 modules puts the RTX 50 Super GPUs in an uncertain position. Launch window and VRAM configurations may shift, and pricing is no longer predictable. The same memory pressure can also affect current Nvidia RTX 50-series lineup, leading to higher MSRPs or shortages.

Reports from various hardware insiders indicate that the RTX 50 Super refresh from Nvidia is now in doubt due to a shortage of 3 GB GDDR7 chips. While one source framed it as entirely canceled, another said it got delayed into Q3 2026, which is more logical.

Nvidia hasn’t officially announced the RTX 50 Super refresh yet. It hasn’t confirmed any changes, but the one common piece of information is that higher-density GDDR7 is the bottleneck for the graphics cards, shaping timing and availability of new Nvidia Super GPUs.

As reported earlier, the potential specification for the Nvidia RTX 50 Super refresh is below. One and a half times increased VRAM (compared to base GPUs) is under question now, too; nothing is certain with the AI accelerators consuming all available memory.

Nvidia RTX 50 Super GPU specifications (unofficial)

RTX 50 Series GPUs Specs Comparison

GPU Model

Nvidia GeForce RTX 5070

Nvidia GeForce RTX 5070 Super

Nvidia GeForce RTX 5070 Ti

Nvidia GeForce RTX 5070 Ti Super

Nvidia GeForce RTX 5080

Nvidia GeForce RTX 5080 Super

VRAM (GDDR7)

12 GB

18 GB

16 GB

24 GB

16 GB

24 GB

Memory Bus

192-bit

192-bit

256-bit

256-bit

256-bit

256-bit

Clock Frequency

2.51 GHz

Unknown

2.42 GHz

Unknown

2.62 GHz

Unknown

CUDA Cores

6144

6400

8960

8960

10752

10752

TDP

250W

275W

300W

350W

360W

At least 396W

US MSRP

$549

Unknown

$749

Unknown

$999

Unknown

If GDDR7 modules stay tight (and memory supply is at an all-time low due to the DRAM supercycle) or expensive, the RTX 50 Super refresh is likely to slip to a later launch, be heavily repriced, or have a lower VRAM configuration.

Memory crisis may affect current RTX 50 GPUs

The pressure is not limited to the upcoming (or not) refresh. Rising memory costs could prompt Nvidia to adjust MSRPs for current RTX 50-series GPUs.

This risk sits within a broader DRAM supercycle: we continue to cover all related news on rising PC hardware prices, while the memory crisis is now spilling from DDR5 RAM to other PC parts and consumer devices, and may soon affect laptops, consoles, and handhelds.

Hardware insider pointed to the potential shortage of the RTX 5060 Ti model with 16 GB of VRAM specifically.

In short, both the rumored Super lineup and today’s RTX 50 models are to be affected by the same memory-driven cost surge and shortage.

Rising gaming hardware prices

Prices are rising across PC hardware and beyond. RAM and storage are feeling pressure from AI data centers. Supply of basic components lags demand, prompting manufacturers to hike prices. Rising costs hit OEMs and are later passed on to customers.

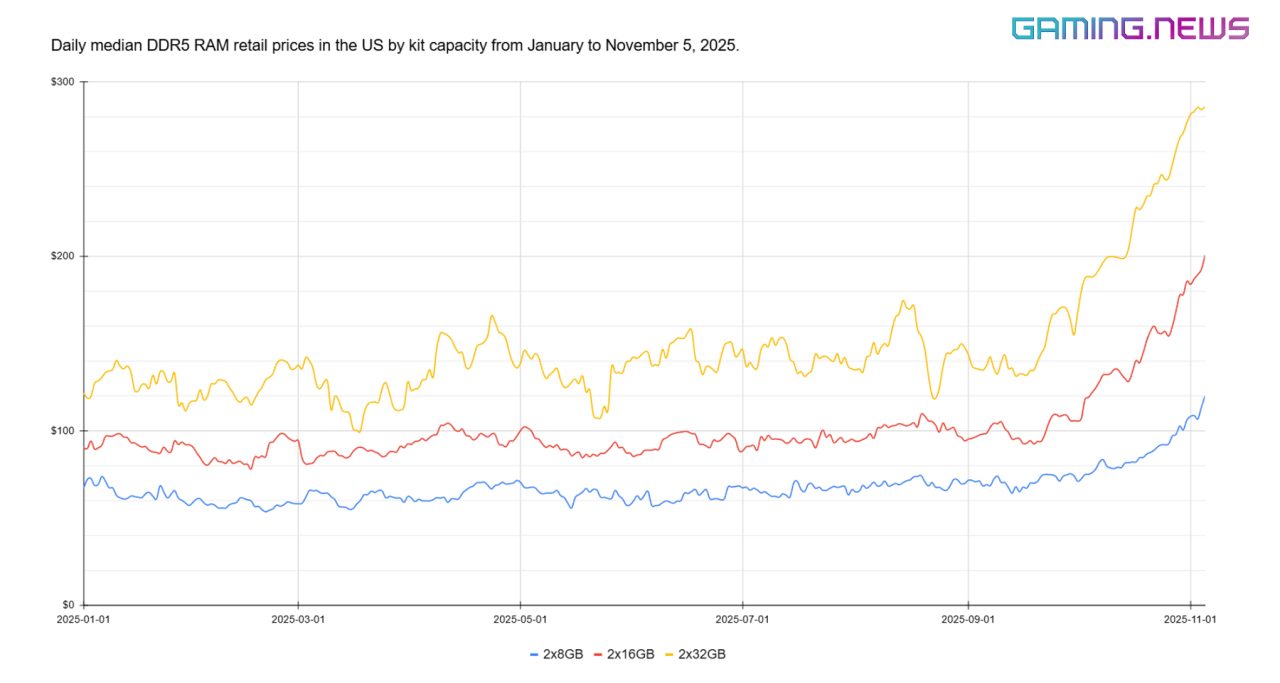

Board partners face higher bills of materials, while tariffs add volatility. The result is that retail prices for modern RAM kits have almost doubled over the past half year, and other hardware may follow suit.

Our most recent snapshot shows a historic high in US DDR5 RAM kit prices. The median price for 2×32 GB kits has moved above $200, while 2×16 GB is now above $120. Over roughly a month, median prices rose about 40% for the whole PC RAM market, while 2×32 GB kits rose 70% in 6 weeks, with momentum building from late September into early November.

These are median retail figures across multiple stores and various manufacturers, indicating a broad repricing of mainstream consumer DDR5 RAM kits.

DRAM supercycle

The previous DRAM supercycle in 2017 followed a simple pattern. Rising smartphone memory and data center demand ran ahead of supply for multiple quarters while suppliers prioritized higher-value parts.

Contract and spot prices climbed for months, and retail RAM kit prices roughly doubled within a year, but the cycle only reversed after inventories rebuilt in late 2018 and through 2019.

Analysts now point to a new memory supercycle that peaks around 2027. DRAM inventories fell to a record low (about 3 weeks of supply) by late Q3 2025. Suppliers are diverting all existing capacity toward an endless stream of AI demand.

Leading vendors have signaled DRAM contract hikes from all major memory manufacturers (Samsung, Micron, and SK Hynix), and those hikes have already been passed on to consumers through rising RAM prices. The result is a multi-quarter pricing uptrend with potential shortages that can persist into 2026 before easing.

Warnings from hardware industry

Memory makers are signaling that relief isn’t coming soon. Micron expects tight DRAM conditions to persist through 2026, while Adata’s chairman, Simon Chen, says AI buyers are outbidding the PC market, upstream inventory has fallen to roughly two to three weeks, and his teams were told to sell sparingly and prioritize long-term customers—conditions he expects to last into 2026.

The memory squeeze is starting to show up in smartphones. Xiaomi warned that rising memory costs are pushing device prices higher and adjusted Redmi K90 launch pricing, then temporarily discounted the 12/512 GB model after consumer pushback. Memory inflation flows into retail pricing too fast for usual consumers.

Why are hardware prices rising?

Prices are rising because AI is absorbing most of the memory output, leaving less manufacturing capacity for other products. Suppliers raise contract prices when fabs are full, partners pass those costs through, and retail follows suit as restocks land at higher prices with fewer sales and options are available.

It is basic supply and demand. Until new fabrication capacity comes online or AI demand is satisfied, pressure persists, and RAM or SSD shortages can appear, concurrently with price increases.

Recent multi-billion-dollar hardware deals and long-term supply commitments in the AI sector lock in even more capacity:

- Nvidia to invest up to $100 billion in OpenAI and bring 10 GW of AI GPUs to data centers.

- Nvidia to invest $2 billion in xAI to lock a $20 billion deal for its own AI accelerators.

- Nvidia commits about $5 billion to Intel to develop AI hardware.

- OpenAI signed a new AI GPU supply deal with AMD.

- OpenAI and Broadcom signed an agreement for 10 GW of custom AI accelerators.

TL;DR

To summarize, analysts expect this DRAM upcycle to run into 2027. Beyond RAM, storage is getting pricier as Adata and Micron warned, and price hikes are filtering into devices that rely on memory and storage, including phones, laptops, consoles, handhelds, and GPUs, with Xiaomi already signaling the trend.

As a reminder, despite Nvidia’s long history in gaming GPUs, its primary revenue now comes from data centers. And price increases reach consumers gradually, since a graphics card passes through a long chain of companies before it reaches the shelf.